Adani Total Gas Limited – Financials, Fundamentals, Detailed Analysis, and Adani Total Gas Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030, 2040).

Adani Total Gas, one of the renowned subsidiaries of Adani Group has given a tremendous return of +208% from 2021 to 2023.

For some days, the share of Adani Group has grown very rapidly. Whatever allegations were made by Hindenburg have been cleared by the Supreme Court and the allegations made so far have not been proven true.

However, Details of 2-3 allegations are not known yet, but after this news, shares of Adani Group started touching the sky. Another reason could be that The US government provided a $553 million loan to Gautam Adani’s conglomerate for a container terminal in Sri Lanka, which was canceled last time due to the Hindenburg report.

Adani Total Gas Overview

Adani Total Gas Limited is a joint venture between Adani Group and TotalEnergies. The company operates in the natural gas sector, focusing on the distribution and marketing of natural gas in various forms, including piped natural gas (PNG) for homes, compressed natural gas (CNG) for vehicles, and compressed natural gas (CNG) for industries. Includes liquefied natural gas (LNG)—and commercial use.

Adani Total Gas has a presence in several cities in India and is involved in expanding the reach of natural gas infrastructure. The company is important in promoting clean and sustainable energy solutions by providing an alternative to traditional fossil energy.

| Company | Adani Total Gas Ltd. |

| Founded in | August 5th 2005 |

| Headquarter | Ahmedabad |

| Subsidiaries | IndianOil-Adani Gas Pvt. Ltd., and MORE |

Adani Total Gas Financial

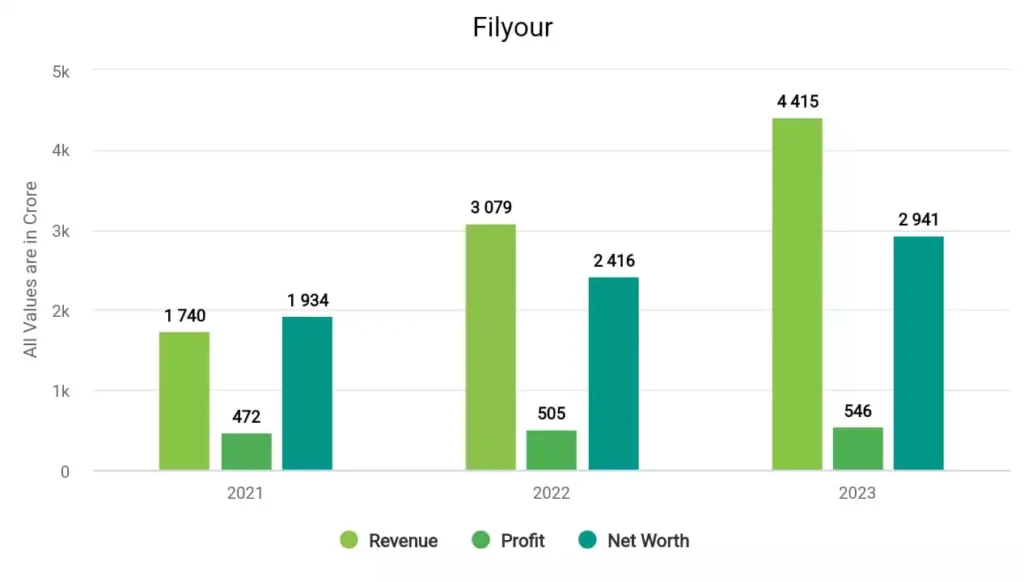

In 2021, the company’s revenue surged to 1,740 crores, and its profit was 472 crore. In 2022, the company made a profit of 505 crore with a revenue of 3,079 crore. And in 2023, Alstone earned a strong profit of 546 crore and a revenue of 4,415 crore.

Adani Total Gas Fundamentals

| Market Cap. | ₹93,308 Cr |

| P/E ratio | 135.31 |

| Industry P/E | 19.31 |

| ROE | 18.64% |

| EPS | 6.27 |

| Book Value | 32.55 |

| Dividend Yield | 0.03% |

| Debt to Equity | 0.43 |

Matrics Explained –

- Market Cap (Market Capitalization): ₹93,308 Crore: Market capitalization represents the total market value of a company’s outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): 135.31: A P/E ratio of 135.31 indicates that investors are willing to pay ₹135.31 for every ₹1 of earnings per share (EPS).

- Industry P/E (Price-to-Earnings Ratio): 26.06: The industry’s average P/E ratio is 26.06. Comparing this to the company’s P/E of 135.31 suggests that the company’s stock is trading at a significantly higher valuation than the industry average.

- ROE (Return on Equity): 18.64%: An ROE of 18.64% indicates that the company generated a profit of 18.64% for every rupee of shareholders’ equity. This is a positive ROE, suggesting that the company generates a good return for its shareholders.

- EPS (Earnings Per Share): ₹6.27: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company earned ₹6.27 for each outstanding share over a specific period.

- Book Value: ₹32.55: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹32.55 per share.

- Dividend Yield: 0.03%: A dividend yield of 0.03% suggests a meager dividend payout relative to the stock price.

- Debt to Equity Ratio: 0.43: A ratio of 0.43 indicates that the company has 0.43 rupees in debt for every rupee of equity.

Adani Total Gas share price target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Adani Total Gas share price target 2024 | ₹1390 | ₹1445 |

| Adani Total Gas share price target 2025 | ₹1737 | ₹1908 |

| Adani Total Gas share price target 2026 | ₹2171 | ₹2499 |

| Adani Total Gas share price target 2027 | ₹2714 | ₹3274 |

| Adani Total Gas share price target 2028 | ₹3393 | ₹4290 |

| Adani Total Gas share price target 2029 | ₹4241 | ₹5619 |

| Adani Total Gas share price target 2030 | ₹5302 | ₹7362 |

| Adani Total Gas share price target 2040 | ₹6628 | ₹9644 |

Adani Total Gas share more details are available in this video –

Adani Total Gas share price target 2024

Adani Total Gas can be a multi-bagger stock in the long term. The company is fully focused on producing green energy which will impact the share price due to which we can get to see a rally in the share, as said by the experts. Since, after the Hindenburg reports, the share price of this stock was well declined, creating a new opportunity for the investors who eagerly wanted to invest in it. The conclusion that has been made regarding Adani Total Gas share price target 2024, which can be INR 1390 the lowest share price while the highest price can be INR 1445.

Adani Total Gas share price target 2025

Since the share has given a return of +53% in the 6 months while -71% in the last year and +178% in the last 5 years, the experts are expecting returns of 25% CAGR which might be possible. Some analysts are saying that the stock has performed quite well in the past but currently, the share is overvalued. According to our research, we have predicted that the lowest and the highest Adani Total Gas share price target 2025 can be INR 1737 and INR 1908 respectively.

Adani Total Gas share price target 2030

It might be possible that this share become multi-bagger by 2030. According to its past performance, the lowest price of Adani Total Gas share price target 2030 will be INR 5302 while the highest price can be INR 7362.

Adani Total Gas share price target 2040

If you want to stay with this share for the long term then the possibility of getting good returns is high because the Actual profit is made by staying in the market not by leaving the market. Analysts are quite bullish on this stock and as we can see the stock has risen more than what we expected. So, the Adani Total Gas share price target for 2040 can be INR 6628, and the highest share price can go up to INR 9644.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Adani Total Gas Share Price Target for 2023, 2024, 2025, 2026, and 2030.

If you want to know anything else about it, then you can comment, and we will try our best to give you the best answer. And yes, If you liked this article, then definitely share it as much as possible.

FAQs

Is Adani Total Gas debt-free?

No, Adani Total Gas is not a debt-free company, it has a debt of only ₹1,557 crore.

What is the Adani Total Gas share price target for 2026?

The share price target of Adani Total Gas for the year 2026 can be INR 2171 and INR 2499 can be the highest share price.

Also Read –