Future Consumer Ltd. – Financials, Fundamentals, Share Analysis, and Future Consumer Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

Are you looking for Future consumer Share Price Target? If yes, then you are at the right place. In this post, we are going to analyze Future Consumer share so that it becomes easy for you to decide whether to invest in it or not.

Future Consumer is a penny share and has given returns of -89% from 2011 to 2023. According to experts, investing in this stock is quite risky but some people are saying that this stock will give multi-bagger returns.

So, my question is from you guys, Will Future Consumer Stock give multi-bagger returns in the future? If yes, then how, or if no then why? The answers to all these questions are in this post, so read this post thoroughly So that you can make the right investment decisions.

Future Consumer Overview

Future Consumer is a subsidiary of Future Group which is a major Indian company founded by Kishore Biyani. The company is primarily engaged in the business of consumer goods and operates in several sectors of the consumer industry. Future Consumer has introduced several well-known brands in the market.

Some of its popular brands include “Tasty Treat” for snacks and packaged foods, “CleanMate” for home cleaning products, “Golden Harvest” for rice and wheat flour, and “ThinkSkin” for personal care items. The products of Future Retail company are available through various retail channels, including its retail stores like “Easyday” and “Heritage Fresh,” as well as other retail chains and supermarkets across the country.

Future Consumer Fundamentals

| Market Cap. | ₹142 Cr |

| P/E ratio | -1.09 |

| Industry P/E | 55.07 |

| ROE | 26.76% |

| EPS | -0.65 |

| Dividend Yield | 0% |

| Book Value | -1.52 |

| Debt to Equity | -1.34 |

Metrics Explained –

- Market Capitalization (Mkt Cap): ₹142 Crores – This indicates the total market value of the company’s outstanding shares. It’s a relatively small market cap.

- Price-to-Earnings Ratio (P/E Ratio): -1.09 – A P/E ratio of -1.09 indicates that the company is not currently generating earnings per share.

- Industry P/E: 55.57 – Compared with the industry P/E, the company might not be generating earnings in line with its industry peers.

- Return on Equity (ROE): 26.76% – A negative ROE suggests that the company is not generating a positive return on shareholders’ equity, which can be a concerning sign.

- Earnings per Share (EPS): -0.65 – This suggests that the company is not making profits per share.

- Dividend Yield: 0.00% – This indicates that the company is not currently offering dividends.

- Book Value: -1.52- This is a negative book value, suggesting that the company’s liabilities might exceed its assets.

- Debt to Equity: -1.34- A negative debt-to-equity ratio suggests that the company might have more equity than debt, which is generally a positive sign.

Future Consumer Financial Trends

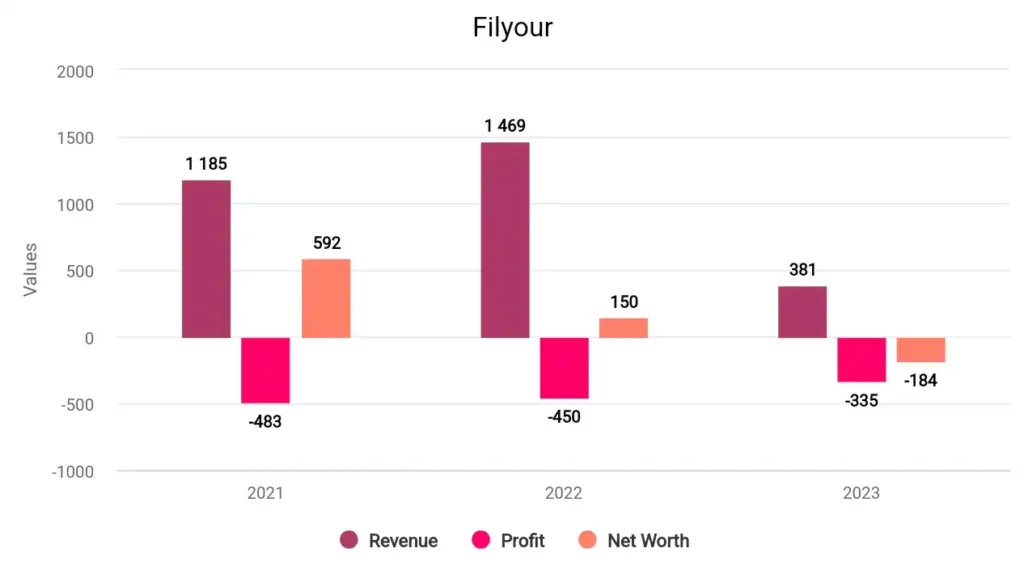

In 2021, the company’s revenue surged to 1,185 crore, and its profit was -493 crore. In 2022, the company made a profit of -450 crore with a revenue of 1,469 crore. And in 2023, Future Consumer earned a strong profit of -335 crore and a revenue of 381 crore.

Future Consumer Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Future Consumer Share Price Target 2023 | ₹0.99 | ₹1.03 |

| Future Consumer Share Price Target 2024 | ₹1.03 | ₹1.11 |

| Future Consumer Share Price Target 2025 | ₹1.07 | ₹1.20 |

| Future Consumer Share Price Target 2026 | ₹1.11 | ₹1.29 |

| Future Consumer Share Price Target 2027 | ₹1.16 | ₹1.40 |

| Future Consumer Share Price Target 2028 | ₹1.20 | ₹1.51 |

| Future Consumer Share Price Target 2029 | ₹1.25 | ₹1.63 |

| Future Consumer Share Price Target 2030 | ₹1.30 | ₹1.76 |

Future Consumer Stock more details are available in this video –

Future Consumer Share Price Target 2024

The past performance of Future Consumer has not been good so far. But in the last 6 months, it has shown a good growth of +26% in its share price while in the last 1 year, the returns were quite declining which is -57%.

According to forecasters, The value of this stock is being deliberately inflated by operators, so staying away from this stock will be a good deal. The price forecasted or Future Consumer Share Price Target 2024 can be INR 1.03 while the maximum price can be INR 1.11.

Future Consumer Share Price Target 2025

If we look at its fundamentals, it is quite bad, and it is often seen that penny stocks have bad fundamentals. I am telling you that I neither invest in these stocks whose fundamentals are weak nor advise anyone to invest in them.

This type of stock is often seen incurring losses due to which many people get trapped by investing in this type of stock. Anyway, by looking at its past performance, it is concluded that Future Consumer Share Price Target 2025 can be INR 1.07 and the maximum price can be INR 1.20.

Future Consumer Share Price Target 2026

Looking at its financial trends, It doesn’t seem easy to make a profit for Future Consumers. The company is incurring losses every year while its net worth has also declined a lot. It seems that the future of this stock is very dark until it turns into a profitable business. Experts are predicting that Future Consumer Share Price Target 2026 can be INR 1.11 and the maximum share price can go up to INR 1.29.

Future Consumer Share Price Target 2030

As we can see, the fundamentals are worse as well and its financial conditions are also not good. In this case, how it will be the best decision to invest where there is no sign of profit? In such a situation, I would suggest you stay away from this stock, otherwise, if you want to invest then do proper research once.

Well, by looking at its historical data, the analyst has predicted that the Future Consumer Share Price Target 2030 can be INR 1.30 while the maximum price can be INR 1.76. So once again I am saying to you that, before investing in it, it will be better for you to do proper research by yourself.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Future Consumer Share Price Targets for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of Future Consumer share?

There is quite a possibility of getting huge losses from Future Consumer shares in the future.

Is Future Consumer debt free?

No, Future Consumer has a debt of ₹ 428 Crore.

Also Read –