In today’s post, we will talk about Dwarikesh sugar Share Price Target. Along with this, we will also do a detailed analysis of Dwarikesh Sugar Industries Limited.

This is a small capitalization stock that has high growth potential but the chances of losing money in it are also high. The fundamentals and financials of Dwarikesh Sugar are almost good. So, just because its fundamentals and financials are good, we can consider it a good investment?

Since, I have been in the market for the past 3 years, and I found that Out of 10, only 2 or 3-penny stocks can give good returns in the future. In such cases, doing a proper analysis of stocks mainly small-cap stocks, becomes very important. If we look at Dwarikesh Sugar all all-time returns from 2005 to 2023, it is +603% i.e. average returns of +31% which is quite good.

So should we invest in it just by looking at its past returns? No right, so in this post today we will analyze Dwarikesh Sugar in detail so that you can decide for yourself whether it will be a good investment or not.

Dwarikesh Sugar Overview

Dwarikesh Sugar Industries Limited is an Indian company that is engaged in the production of sugar and related products. The company is involved in the manufacturing of sugar which is one of the primary businesses in the Indian agriculture sector. The Dwarikesh processes sugarcane to produce sugar in various forms of sugar.

Dwarikesh Sugar Industries Limited has a market presence in India and may also export its sugar and related products to international markets. In addition to sugar, Dwarikesh Sugar has ventured into ethanol production. Ethanol is a biofuel produced from sugarcane and other feedstocks.

Dwarikesh Sugar Financials

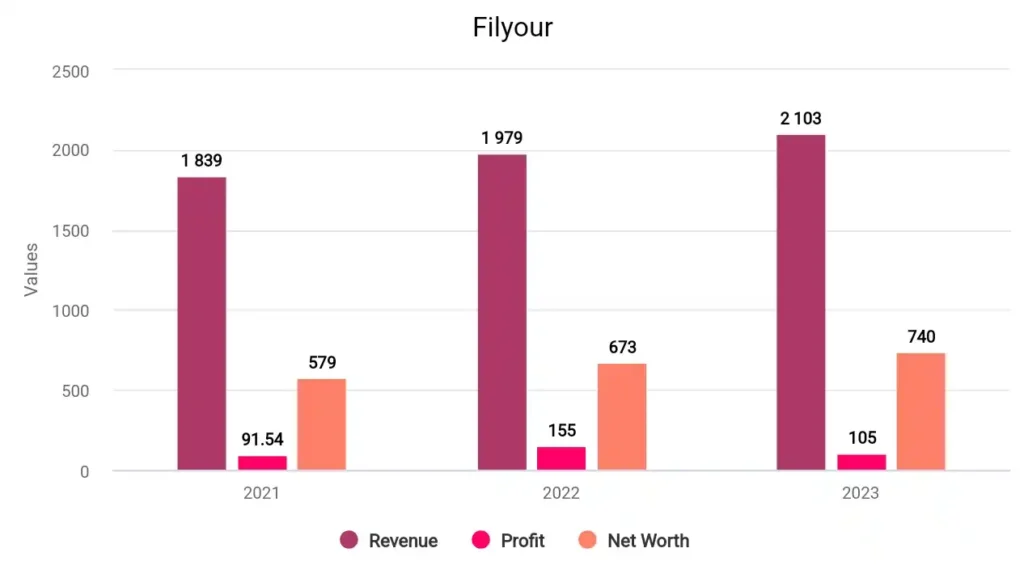

In 2021, the company’s revenue surged to 1,839 crore, and its profit was 91.54 crore. In 2022, the company made a profit of 155 crore with a revenue of 1,979 crore. And in 2023, Dwarikesh Sugar earned a profit of 105 crore and a revenue of 2,103 crore.

Dwarikesh Sugar Fundamentals

| Market Cap. | ₹1,335 Crore |

| P/E ratio | 40.26 |

| Industry P/E | 26.70 |

| ROE | 10.16% |

| EPS | 1.79 |

| Book Value | 44.35 |

| Dividend Yield | 0.55% |

| Debt To Equity | 0.55 |

Metrics Explained –

- P/E Ratio (Price-to-Earnings Ratio): 40.26: The P/E ratio is a valuation metric that indicates the price investors are willing to pay for each rupee of earnings generated by the company. A P/E ratio of 40.26 means that, at the current stock price, investors are willing to pay ₹40.26 for every ₹1 of earnings per share (EPS) generated by the company.

- Industry P/E (Price-to-Earnings Ratio): 26.70: This represents the industry P/E ratio is less than the average P/E ratio which is 40.26. This means that the company is trading at a premium.

- ROE (Return on Equity): 10.16%: ROE is a measure of a company’s profitability relative to its shareholders’ equity. An ROE of 10.16% means that the company generated a profit of 10.16 paise for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹1.79: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, Dwarikesh Sugar Industries Limited earned ₹1.79 for each outstanding share over a specific period.

- Book Value: ₹44.35: The book value per share is the company’s net asset value divided by the number of outstanding shares. It represents the value of each share if the company were to be liquidated. In this case, the book value per share is ₹44.35.

- Dividend Yield: 0%: Dividend yield is the annual dividend payment made by the company as a percentage of its stock’s current market price. A dividend yield of 0% means that, at the current stock price, the company is paying out dividends equivalent to 0% of the stock’s value.

- Debt To Equity: 0.55: The debt-to-equity ratio is a measure of a company’s financial leverage. A ratio of 0.55 indicates that, for every rupee of equity, the company has 55 paise in debt. This suggests a relatively conservative level of debt.

Dwarikesh Sugar Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Dwarikesh Sugar Share Price Target 2024 | ₹107 | ₹115 |

| Dwarikesh Sugar Share Price Target 2025 | ₹116 | ₹129 |

| Dwarikesh Sugar Share Price Target 2026 | ₹125 | ₹145 |

| Dwarikesh Sugar Share Price Target 2027 | ₹135 | ₹162 |

| Dwarikesh Sugar Share Price Target 2028 | ₹146 | ₹182 |

| Dwarikesh Sugar Share Price Target 2029 | ₹158 | ₹204 |

| Dwarikesh Sugar Share Price Target 2030 | ₹171 | ₹256 |

Dwarikesh Sugar share more details are available in this video –

Dwarikesh Sugar Share Price Target 2024

The fundamentals of Dwarikesh Sugar are quite well which is the best thing about this penny stock. The P/E ratio is 17.33 while Industry P/E is 18.05. The ROE and EPS of Dwarikesh Sugar are 16% and 5.62 respectively, which is considered good. Looking at its financial trends, it is predicted that Dwarikesh Sugar Share Price Target 2024 can be INR 107 and the maximum price can go up to INR 115.

Dwarikesh Sugar Share Price Target 2025

In 2025, the share can perform well because its financial trends are good and it is predicted that by 2025 the company will make huge profits in its business. But keep in mind that it is a penny stock which carries high risk along with high rewards. Looking at its historical data it is concluded that Dwarikesh Sugar Share Price Target 2025 will be INR 116 and the maximum price can be INR 129.

Dwarikesh Sugar Share Price Target 2030

Since this is a penny share I don’t recommend anyone to invest in penny stocks mainly by seeing its share price target. Dwarikesh Sugar is a good share but this type can be manipulated, so invest in it only if you have good confidence in this share. By the way, Dwarikesh Sugar Share Price Target 2030 can be INR 171 and the maximum price can be INR 256.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Dwarikesh Sugar’s Share Price Target for 2024, 2025, 2026 and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of Dwarikesh Sugar Share?

There is quite a possibility of getting multi-bagger returns from Dwarikesh Sugar share in the future. But for this, you have to invest in Dwarikesh’s share wisely and for a long-term horizon.

Is Dwarikesh Sugar debt-free?

No, Dwarikesh Sugar has a debt of ₹ 456 Crore.

Also Read –