GVK Power Share Price Target 2024 – 2030 (Best Analysis of GVK Power Limited stock, Fundamentals, Financials, Future Plans and more)

Are you looking for a GVK Power Share Price Target? If yes, Then you are at the right place.

In this post, I will tell you about GVK Power Share Price Target, Along with this, we will do a detailed analysis of GVK Power shares. Well, this is a penny stock so investing in it is a bit risky.

The GVK Power share has given a return of +38% from Aug 2022 to Sep 2023. From there, the share is showing significant growth but even then investing in this share is very risky. Why I am saying this, you will know later in this post, so stay tuned till the end of this blog.

GVK Power Overview

GVK Power & Infrastructure Limited is an amalgamation based in Bharat. The company has interests in various sectors like as energy, hospitality, transportation, and infrastructure development.

The company was incorporated in 1994 by Dr GVK Reddy and it has grown remarkably and played an important role in the Bharat infrastructure and power sectors. GVK Power & Infrastructure Limited has been actively engaged in developing transportation infrastructure projects, including airports and roads.

GVK Power Financials

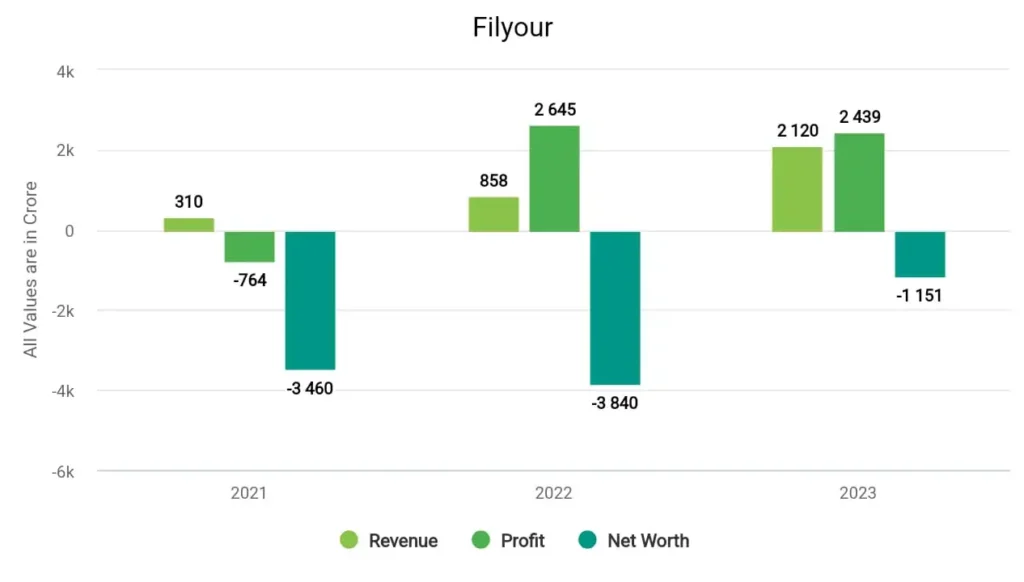

In 2021, the company’s revenue surged to ₹310 crore, and its profit was ₹-764 crore. In 2022, the company made a profit of ₹2,645 crore with a revenue of ₹858 crore. In 2023, GVK Power earned a profit of ₹2,439 crore and a revenue of ₹2,120 crore.

GVK Power Fundamentals

| Market Cap. | ₹820 Cr |

| P/E ratio | 43 |

| Industry P/E | 34.14 |

| ROE | -1.73% |

| EPS | -0.69 |

| Book value | -7.49 |

| Dividend Yield | 0 |

| Debt to Equity | -3.89 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹820 Crores: Market capitalization represents the total market value of a company’s outstanding shares. In this case, it’s ₹820 Crores, which suggests that this is a relatively small-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): -7.52: A P/E ratio of -7.52 indicates that investors are willing to pay -7.52 rupees for every earnings per share (EPS).

- Industry P/E (Price-to-Earnings Ratio): 38.02: The industry’s average P/E ratio is 38.02. Comparing Industry P/E to the company’s P/E ratio of 432 suggests that the company’s stock may be overvalued.

- ROE (Return on Equity): -1.73%: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of -1.73% indicates that the company generated a profit of -1.73% for every rupee of shareholders’ equity. This is a relatively good ROE.

- Book Value: -₹7.49: The book value per share is the net asset value of the company divided by the number of outstanding shares. A negative book value per share can be an unusual and very concerning metric, suggesting that the company’s liabilities exceed its assets per share.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Debt to Equity Ratio: -3.89: A ratio of -3.89 indicates a negative equity position, which implies that the company’s liabilities exceed its equity.

GVK Power Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| GVK Power Share Price Target 2024 | ₹8.81 | ₹9.47 |

| GVK Power Share Price Target 2025 | ₹9.51 | ₹10.61 |

| GVK Power Share Price Target 2026 | ₹10.27 | ₹11.88 |

| GVK Power Share Price Target 2027 | ₹11.09 | ₹13.31 |

| GVK Power Share Price Target 2028 | ₹11.98 | ₹14.90 |

| GVK Power Share Price Target 2029 | ₹12.94 | ₹16.69 |

| GVK Power Share Price Target 2030 | ₹13.97 | ₹18.69 |

GVK Power Share more details are available in this video –

GVK Power Share Price Target 2025

As I told earlier, Investing in this share is risky because the fundamentals and financial conditions are very bad. The company’s book value is -7.49, which means that if the company becomes insolvent due to any cause, the shareholders will get nothing from the company. Generally, A negative book value per share suggests that the company’s liabilities exceed its assets per share.

The other metrics are the same due to which any investors or I personally not suggest anyone to invest in this type of shares. According to its historical data, The Experts has forecasted that GVK Power Share Price Target 2025 can be INR 9.51 and the highest price can go up to INR 10.10.61.

GVK Power Share Price Target 2030

Looking at its past returns, The share has given a return of +203% in the past 6 months while in the past 1 year, it has given a return of +102% returns, which sounds good right? But the company is making huge profits every year, exceeding its revenue. The profit of the company is ₹2,439 and revenue is ₹2,120 in 2023 i.e. the profit of the company is from other income, not from its business.

Considering these, it is concluded that the price of shares is manipulated by the operators that’s why investing in it will be a trap for you. Looking at its past performance, it is forecasted that GVK Power Share Price Target 2030 will be INR 13.97 while the highest price can be 18.69.

Is it good to Invest in GVK Power Shares?

No, GVK Power is not a good investment for the people who want to play it safe. The share carries huge risk and the chances of getting good returns from this share are negligible. So, my opinion is that investing in some mid-cap or large-cap shares will have the potential to give you better returns in the future.

Conclusion

So how did you like this blog, Please tell by commenting. We have tried to know as much as possible about GVK Power Share Price Target 2024, 2025, 2026, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of GVK Power Share?

There is very little possibility of getting multi-bagger returns from GVK Power share in the future. But for this, you have to invest in GVK Power share wisely and for a long-term horizon.

Is GVK Power debt-free?

No, GVK Power has a debt of ₹ 5,806 Crore.

Also, Read –

- ARC Finance Share Price Target

- Dwarikesh Sugar Share Price Target

- Future Consumer Share Price Target

- Infibeam Avenues Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.

It was really a helpful blog keep posting more such blogs

Thank you