Unitech Limited: Overview Financials, Fundamentals, Detailed Analysis, and Unitech Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030, 2035).

Are you looking for a Unitech Share Price Target? If yes, then you are in the right place.

Unitech Ltd is a small-cap stock so investing in this share can be risky. The share has not performed well in the last 5 years, the return was only +37% which is not considered good.

So, if you want to invest in Unitech shares, this post can be a guideline for your investment. Well, some investors are forecasting that this share will not give investors good returns in the long term. So let’s look at Unitech Share Price Target and try to predict its future.

Unitech Share Overview

Unitech Limited is an Indian real estate conglomerate that operates across diverse segments in the construction industry. The company was incorporated in 1972 and has a significant presence in residential and commercial real estate. Unitech is engaged in housing, retail, hospitality, and infrastructure development projects.

The company tries hard to achieve a wide spectrum of real estate activities, including developing residential spaces, commercial complexes, IT parks, malls, hotels, and infrastructure projects. Unitech has a history of undertaking large-scale projects across various cities in India, contributing to the nation’s urban development.

Unitech Fundamentals

| Market Cap. | ₹2,614 Crore |

| P/E ratio | 0 |

| Industry P/E | 84.53 |

| ROE | 124.65% |

| EPS | -11.54 |

| Book Value | -7.86 |

| Dividend Yield | 0% |

| Debt to Equity | -2.50 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹2,614 Crores: Market capitalization signifies the total market value of a company’s outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): 0: A P/E ratio of 0 typically suggests that either the company has negative earnings or the earnings are unavailable.

- Industry P/E (Price-to-Earnings Ratio): 84.53: The industry’s average P/E ratio is 84.53. Comparing the company’s P/E of 0 with the industry average suggests that the company might not be generating positive earnings or might significantly underperform the industry average in terms of profitability.

- ROE (Return on Equity): 124.65%: ROE measures a company’s profitability concerning shareholders’ equity. An ROE of 124.65% indicates that the company generated a profit of 326.26% concerning each rupee of shareholders’ equity.

- EPS (Earnings Per Share): -11.54: In this instance, the negative EPS of -11.54 means the company experienced a loss per share over a specific period.

- Book Value: -7.86: . It is a negative value, indicating a potential issue with liabilities exceeding assets.

- Dividend Yield: 0%: A dividend yield of 0% indicates that the company did not pay any dividends during the period.

- Debt to Equity Ratio: -2.50: The debt-to-equity ratio represents a company’s financial leverage.

Unitech Financials Trend

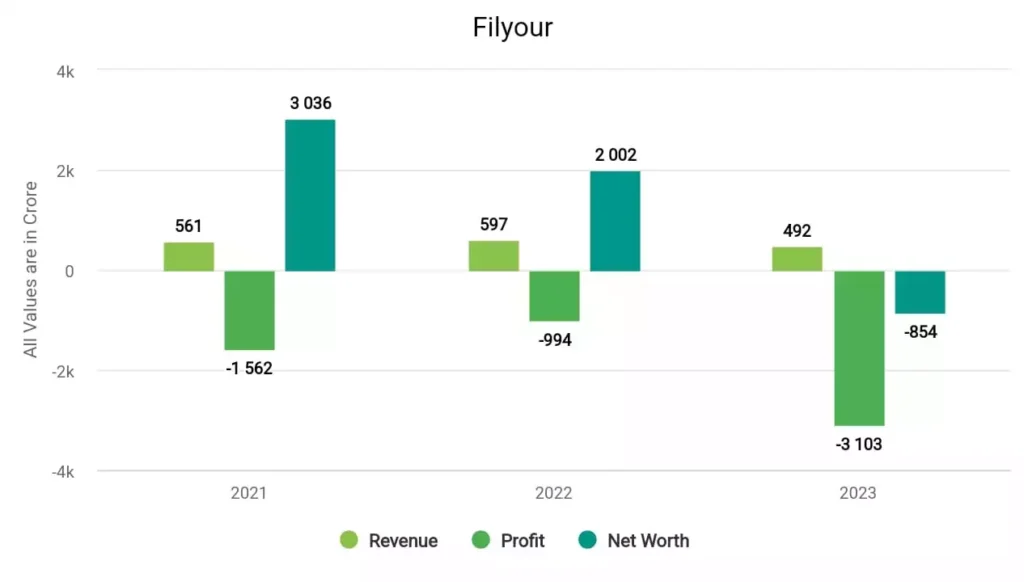

In 2021, the company’s revenue surged to ₹561 crore, and its profit was ₹-1,562 crore. In 2022, the company made a profit of ₹-994 crore with a revenue of ₹597 crore. In 2023, Unitech made a profit of ₹-3,103 crore and a revenue of ₹492 crore.

Unitech Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Unitech Share Price Target 2024 | ₹9.36 | ₹9.42 |

| Unitech Share Price Target 2025 | ₹9.63 | ₹9.76 |

| Unitech Share Price Target 2026 | ₹6.92 | ₹10.14 |

| Unitech Share Price Target 2027 | ₹10.23 | ₹10.55 |

| Unitech Share Price Target 2028 | ₹10.57 | ₹11.01 |

| Unitech Share Price Target 2029 | ₹10.94 | ₹11.51 |

| Unitech Share Price Target 2030 | ₹11.33 | ₹12.06 |

| Unitech Share Price Target 2035 | ₹15.80 | ₹17.00 |

Unitech Share more details are available in this video –

Unitech Share Price Target 2024

The share has overperformed in the last year. Unitech share has given returns of +87% and +145% in the last 6 months which is quite interesting. The experts are expecting good returns from this share due to which Unitech Share Price Target 2024 can be INR 9.36 and the highest price can be INR 9.42. Investing in this share is quite risky so do proper research while investing in this share for the short term.

Unitech Share Price Target 2025

By the way, Unitech share has the potential to give multi-bagger returns in the long term but certain things are to be considered while investing in it. The financials and fundamentals of the company are very bad which means It doesn’t make any sense to invest in it. Well, According to its past performance, the lowest and highest Unitech Share Price Target 2025 can be INR 9.63 and INR 9.76 respectively.

So the question comes why is this stock continuously increasing? Well, We don’t have the exact answer to this but as we have come to know it is being said that the share is being operated due to which an uptrend is being seen in the share price. Therefore, investing in this share can be very risky due to which there are many chances of losing your money.

Unitech Share Price Target 2030

Unitech Share Price Target 2030 can reach INR 11.33 and if the stock hits this target then we can see another target of INR 12.06. As we analyzed, the share is not good for investing where it is for the short term or the long term.

Future of Unitech Share

Well, Unitech Ltd is fundamentally as well as financially bad Which shows its future is in darkness. Some so-called advisors are speculating that this share will double your money soon. Although this is also true, it is a very risky investment and once this share opens the gap down, it will become difficult for you to sell the shares and your money will remain stuck.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Unitech share price target for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, then you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible

FAQs

What is the Debt of Unitech company?

The debt of Unitech company is ₹ 7,230 crore and its debt-to-equity ratio is -2.50.

What is the share price of Unitech in 2025?

The share price of Unitech in 2025 can be ₹9.63 while the highest price can be ₹9.76.

Also Read –

- IDFC First Bank Share Price Target

- Rama Steel Share Price Target

- Olectra Greentech Share Price Target

- Zenith Steel Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.