Coffee Day Limited – Financials, Fundamentals, Detailed Analysis, and Coffee Day Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for a Coffee Day Share Price Target, then you are at the right place.

In this post, we will do a detailed analysis of Coffee Day company, in which we also learn about its fundamentals, financials, and Cafe Coffee Day share price target.

Coffee Day, an FMCG sector stock has performed badly in the past few years. The stock has given a return of -80% from 2015 to 2023, which is not good at all. Some investors are expecting multi-bagger returns from this stock, so can this stock do it? Today we will know the answers to these questions in this post.

Coffee Day Overview

Cafe Coffee Day is a well-known coffee shop chain in India that was established by V.G. Siddhartha in 1996. It has since grown into one of Bharat’s biggest and most recognizable coffee chains which is playing a significant role in shaping Bharat coffee culture and cafe scene. This is what you must know about Coffee Day –

- Coffee Day has a big network of coffee shops across Bharat where customers can enjoy a wide range of coffee-based beverages, snacks, desserts, etc.

- Café Coffee Day has its coffee plantations in Chikmagalur, Karnataka, which ensures a healthy supply of high-quality coffee beans.

- Café Coffee Day faced a significant challenge in July 2019 when its founder, V.G. Siddhartha, passed away.

- In early 2020, it was announced that CCD was acquired by the Coffee Day Group, a conglomerate that includes various businesses, including coffee plantations and real estate.

Coffee Day Financials

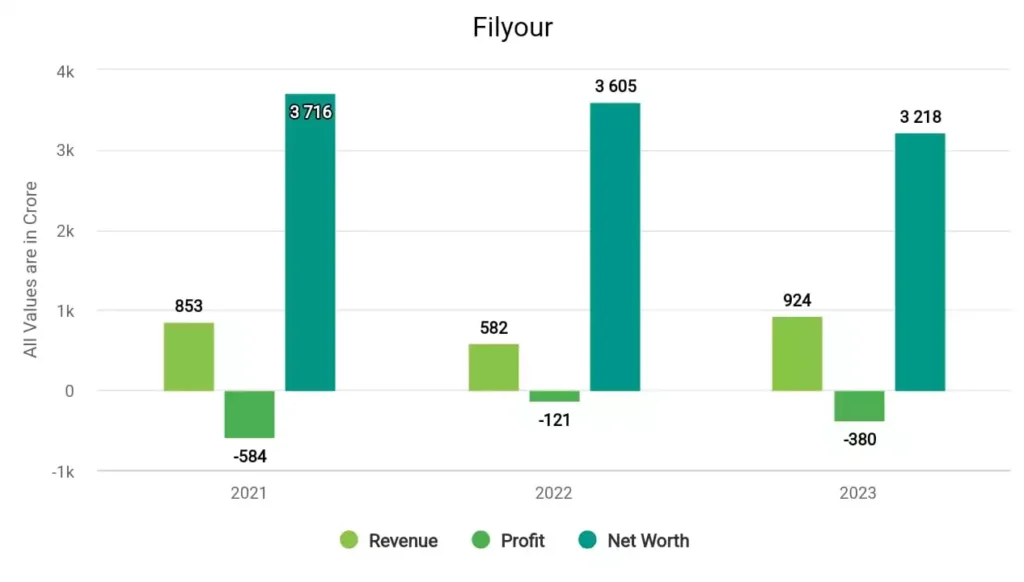

In 2021, the company’s revenue surged to ₹853 crore, and its profit was ₹-584 crore. In 2022, the company made a profit of ₹-121 crore with a revenue of ₹582 crore. In 2023, Coffee Day earned a profit of ₹-380 crore and a revenue of ₹924 crore.

Coffee Day Fundamentals

| Market Cap. | ₹826 Crore |

| P/E ratio | -2.33 |

| Industry P/E | 162.31 |

| ROE | -5.46% |

| EPS | -16.78 |

| Dividend Yield | 0 |

| Book Value | 135.22 |

| Debt to Equity | 0.48 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹826 Crores: Market capitalization represents the total market value of a company’s outstanding shares. In this case, it’s ₹826 Crores, indicating that this is a relatively small-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): -2.33: A P/E ratio of 0 usually indicates that the company has reported negative or no earnings. It’s important to investigate why the P/E is -2.33, as it can be due to various reasons, such as losses or recent IPOs.

- Industry P/E (Price-to-Earnings Ratio): 162.31: The industry’s average P/E ratio is 162.31. Comparing this to the company’s P/E of -2.33 suggests that the company might not be generating positive earnings or might be significantly underperforming the industry average in terms of profitability.

- ROE (Return on Equity): 5.46%: ROE measures the company’s profitability relative to shareholders’ equity.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹135.22: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹135.22 per share.

- Debt to Equity Ratio: 0.48: The debt-to-equity ratio is a measure of financial leverage. A ratio of 0.48 indicates that the company has 48 paise in debt for every rupee of equity.

Coffee Day Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Coffee Day Share Price Target 2023 | ₹36.16 | ₹38.24 |

| Coffee Day Share Price Target 2024 | ₹40.65 | ₹45.23 |

| Coffee Day Share Price Target 2025 | ₹45.51 | ₹53.06 |

| Coffee Day Share Price Target 2026 | ₹50.75 | ₹61.82 |

| Coffee Day Share Price Target 2027 | ₹56.41 | ₹71.64 |

| Coffee Day Share Price Target 2028 | ₹62.52 | ₹82.64 |

| Coffee Day Share Price Target 2029 | ₹76.25 | ₹94.96 |

| Coffee Day Share Price Target 2030 | ₹83.95 | ₹108.75 |

Coffee Day Share more details are available in this video –

Coffee Day Share Price Target 2024

The financial and fundamentals of Coffee Day share are a bit worrying. Currently, the company is in huge loss due to which its fundamentals are deteriorating. If the company improves its fundamentals and financial conditions then it will be a good investment for investors. Anyway, the Coffee Day Share Price Target 2024 can be INR 40 and the maximum price can be INR 45.

Coffee Day Share Price Target 2025

Rally can be seen in this stock in 2025 as it is growing very fast. As we can see, it has given returns of +63% in the last 6 months to date. That is, on average it has given returns of 10% every month. And we expect this stock to give returns of up to 15% this year. That is why, Coffee Day Share Price Target 2025 will be INR 45 and the maximum price can go up to INR 53, which is a good return.

Coffee Day Share Price Target 2030

Coffee Day will also perform very well in 2030. Investors are also saying that this stock can prove to be a very good investment for the long term. If we talk about the Coffee Day Share Price Target 2030, then the first and second targets can be INR 83 and INR 108 respectively. But keep in mind that investing in stock may be very risky, so it becomes very important to have proper knowledge of that stock, in which you want to invest.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, Please tell by commenting. We have tried to know as much as possible about Coffee Day Share Price Target 2024, 2025, 2026 and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of Coffee Day Share?

There is very little possibility of getting multi-bagger returns from Coffee Day shares in the future. But for this, you have to invest in Coffee Day share wisely and for a long-term horizon.

Is Coffee Day debt-free?

No, Coffee Day has a debt of ₹ 1,363 Crore.

Also Read –