Adcon Capital Services Ltd – Financials, Fundamentals, Detailed Analysis, and Adcon Capital Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

In today’s post, I am going to do a detailed analysis of Adcon Capital Share and along with this, I will also try to forecast Adcon Capital Share Price Target, so stay tuned till the end of the blog.

Adcon Capital Services Ltd is a penny share so investing in it may be quite risky. This share has given a return of +188% from 2018 to 2023 which is an average return of +37% per year. But, will we consider it a good stock just by looking at its past returns? no right.

Adcon Capital Overview

Adcon Capital Services Limited operates as a reputed Non-Banking Financial Company (NBFC) and is registered and regulated by the Reserve Bank of India (RBI). This listed NBFC holds an important position in India’s financial sector, offering a wide range of financial services which include providing loans and advances, making strategic investments in shares of other enterprises, and providing a range of related financial solutions.

Adcon Capital Services Limited Renowned for its unwavering commitment towards transparency and regulatory compliance it stands as a trusted financial partner, adept at serving the diverse financial needs of both individuals and businesses.

Adcon Capital Financials

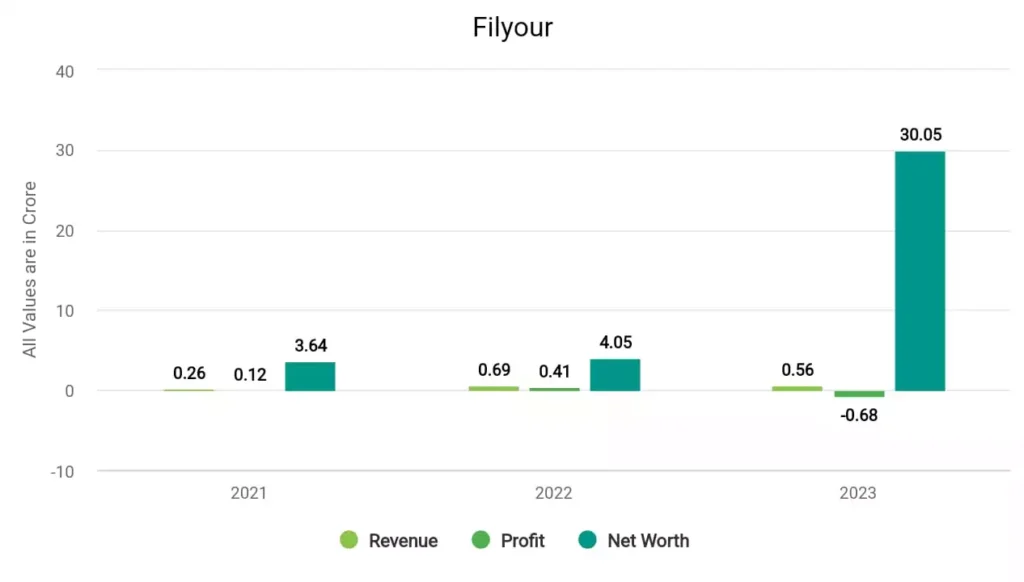

In 2021, the company’s revenue surged to ₹0.26 crore, and its profit was ₹0.12 crore. In 2022, the company made a profit of ₹0.41 crore with a revenue of ₹0.69 crore. In 2023, Adcon Capital made a profit of ₹-0.68 crore and a revenue of ₹0.56 crore.

Adcon Capital Fundamentals

| Market Cap. | ₹16 crore |

| P/E ratio | 20.25 |

| Industry P/E | 24.98 |

| ROE | 2.74% |

| EPS | 0.04 |

| Dividend Yield | 0% |

| Book Value | 1.07 |

| Debt to Equity | 0 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹16 Crores: ₹16 Crores, indicating that this is a micro-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 20.25: A P/E ratio of 20.25 suggests that investors are willing to pay 20.25 times the company’s current earnings for a share of its stock.

- Industry P/E Ratio: 24.98: Comparing the company’s P/E ratio to the industry average can provide insights into its relative valuation.

- ROE (Return on Equity): 2.74%: ROE is a measure of a company’s profitability that compares net income to shareholders’ equity. An ROE of 2.74% indicates a relatively low return on equity.

- EPS (Earnings Per Share): ₹0.04: EPS is a company’s profit divided by the number of outstanding shares. In this case, the company has an EPS of ₹0.04.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period

- Book Value: ₹1.07: The book value per share is the net asset value of the company divided by the number of outstanding shares.

- Debt to Equity Ratio: 0: A ratio of 0 indicates that the company has no debt or a negligible amount of debt compared to its equity.

Adcon Capital Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Adcon Capital Share Price Target 2023 | ₹1.64 | ₹1.69 |

| Adcon Capital Share Price Target 2024 | ₹1.74 | ₹1.84 |

| Adcon Capital Share Price Target 2025 | ₹1.85 | ₹2.01 |

| Adcon Capital Share Price Target 2026 | ₹1.96 | ₹2.19 |

| Adcon Capital Share Price Target 2027 | ₹2.07 | ₹2.38 |

| Adcon Capital Share Price Target 2028 | ₹2.20 | ₹2.60 |

| Adcon Capital Share Price Target 2029 | ₹2.33 | ₹2.83 |

| Adcon Capital Share Price Target 2030 | ₹2.47 | ₹3.09 |

Adcon Capital Share Price Target 2024

This share has given returns of +119% in the last years while -20% in the last 6 months, which sounds bad right? Currently, the share price is falling which is not a good sign. In the short term, the predicted returns or Adcon Capital Share Price Target 2024 can be INR 1.74 and the maximum price can be INR 1.84.

Adcon Capital Share Price Target 2025

As we can see from the above table and the financials trend chart, the company is currently not performing well. Its fundamentals are bad as well and its financial trends are also deteriorating.

The ROE and EPS of the share are negative, which is not considered good while the company is also doing a loss of -0.68 crore this year. By the way, by its historical data, it is predicted that Adcon Capital Share Price Target 2025 can be INR 1.85 and the highest price can be INR 2.01.

Adcon Capital Share Price Target 2030

Since Adcon is a penny stock + it is fundamentally weak. So I personally never suggest anyone invest in this type of stock because the chances of getting a loss are high. The experts are forecasting that the lowest and highest Adcon Capital Share Price Target 2030 will be INR 2.47 and INR 3.09.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Adcon Capital’s share price targets for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Adcon Capital company?

The debt of Adcon Capital company is ₹ 0 Crore and its debt-to-equity ratio is 0.0.

What is the share price of Adcon Capital in 2025?

The share price of Adcon Capital in 2025 can be ₹1.85 while the highest price can be ₹2.01.

Also Read –