BLS Infotech Ltd – Financials, Fundamentals, Detailed Analysis, and BLS Infotech Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

Are you looking for the BLS Infotech Share Price Target? If yes, then you are at the right place. In this post, I will do a detailed analysis of BLS Infotech so that you can decide for yourself whether to invest in it or not.

Well, BLS Infotech is a small-cap share and this share has given returns of +177% from 1998 to 2023, which is an average return of +7% which is decent. Some investors are saying that this share will give multi-bagger returns in the future. So how true is this? Today we will know in this post.

BLS Infotech Overview

BLS Infotech Limited is a company that focuses on teaching young people who want to learn information technology (IT) in Bharat. They help the younger generation to gain skills and knowledge in the field of computers. This education helps the learners to make them more employable and ready for jobs in the technology industry.

The company is established in Orissa, Bharat, and it operates its center there. This center likely serves as a place where students can receive IT education and training.

In Simple, BLS Infotech Limited is a company that specializes in providing IT education and training to young people in Bharat which helps them improve their skills and focuses on making them well-prepared for employment opportunities in the IT sector.

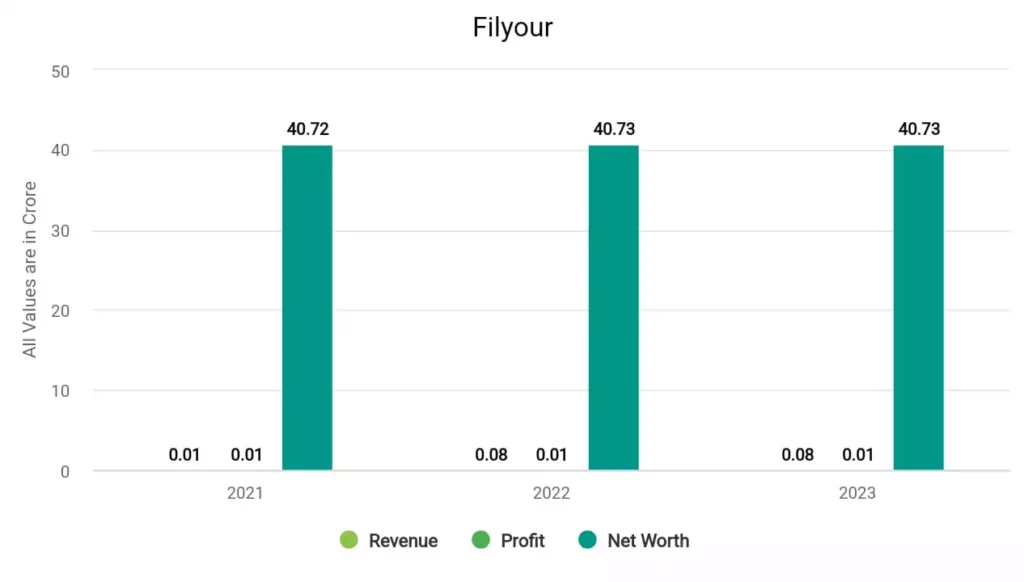

BLS Infotech Financials

In 2021, the company’s revenue surged to ₹0.01 crore, and its profit was ₹0.01 crore. In 2022, the company made a profit of ₹0.01 crore with a revenue of ₹0.08 crore. In 2023, Zenith Steel earned a profit of ₹0.01 crore and a revenue of ₹0.08 crore.

BLS Infotech Fundamentals

| Market Cap. | ₹129 crore |

| P/E ratio | 0 |

| Industry P/E | 72.36 |

| ROE | 0.01% |

| EPS | 0 |

| Book Value | 0.93 |

| Dividend Yield | 0% |

| Debt to Equity | 0 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹129 Crores, indicating that this is a relatively small-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 0: A P/E ratio of 0 usually indicates that the company has reported negative earnings or no earnings. It suggests that at the current stock price, investors are not paying anything for the company’s earnings because there are no reported earnings.

- Industry P/E (Price-to-Earnings Ratio): 73.70: The industry’s average P/E ratio is 62.93. Comparing this to the company’s P/E of 0 suggests that the company might not be generating positive earnings or might be significantly underperforming the industry average in terms of profitability.

- ROE (Return on Equity): 0.01%: An ROE of 0.01% indicates that the company’s earnings are generating a negligible return for shareholders relative to their equity investment.

- EPS (Earnings Per Share): ₹0: An EPS of ₹0 means that the company did not report any earnings per share for the period in question. This is consistent with a P/E ratio of 0, indicating either losses or no earnings.

- Book Value: ₹0.93: The book value per share is the net asset value of the company divided by the number of outstanding shares.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Debt to Equity Ratio: 0: A debt-to-equity ratio of 0 indicates that the company does not have any debt relative to its equity. This suggests a debt-free capital structure.

BLS Infotech Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| BLS Infotech Share Price Target 2023 | ₹2.77 | ₹2.79 |

| BLS Infotech Share Price Target 2024 | ₹3.02 | ₹3.07 |

| BLS Infotech Share Price Target 2025 | ₹3.39 | ₹3.48 |

| BLS Infotech Share Price Target 2026 | ₹3.59 | ₹3.72 |

| BLS Infotech Share Price Target 2027 | ₹3.91 | ₹4.09 |

| BLS Infotech Share Price Target 2028 | ₹4.26 | ₹4.50 |

| BLS Infotech Share Price Target 2029 | ₹4.64 | ₹4.95 |

| BLS Infotech Share Price Target 2030 | ₹5.06 | ₹5.44 |

BLS Infotech Share more details are available in this video –

BLS Infotech Share Price Target 2023

The company share has given good returns of +21% in the last 6 months, while it has given a return of -26%, which sounds bad. Since this is a penny stock it would be foolish to expect good returns from it. The experts predict that the highest and lowest BLS Infotech Share Price Target 2023 can be INR 2.77 and INR 2.79 respectively.

BLS Infotech Share Price Target 2024

The fundamentals of this share are completely turmoiled. Instead of improving the fundamentals of BLS Infotech share, it has become worse. The ROE of this share is 0.01% and EPS is 0, which not sounds good right? That’s why, I am not suggesting anyone invest in these types of shares. Considering this, It is predicted that BLS Infotech Share Price Target 2024 will be INR 3.02 and the highest price can be INR 3.07.

BLS Infotech Share Price Target 2025

The financial trend of this company is also not so good because the profit of the company is still not growing, which is a negative sign. The company’s profit plays a big role in increasing share price but in this case, the profit is bad. The chances of increasing the company’s profit are less, due to which you may see it giving poor returns in the future. By looking at its past performance, it is predicted that BLS Infotech Share Price Target 2025 will be INR 3.39 and the highest price can be INR 3.48.

BLS Infotech Share Price Target 2030

BLS Infotech Share Price Target 2030 can be INR 5.06 and the highest price can be INR 5.44. This share is risky for short-term as well as long-term investment, so my recommendation will be to find another stock that is financially and fundamentally strong.

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about BLS Infotech’s share price target for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of BLS Infotech company?

The debt of BLS Infotech company is ₹ 0 crore that’s why its debt-to-equity ratio is 0.

What is the share price of BLS Infotech in 2026?

The share price of BLS Infotech in 2026 can be ₹3.59 while the highest price can be ₹3.72.

Also Read –