REC Limited: Financials, Fundamentals, Detailed Analysis, and Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

Are you looking for a REC Share Price Target? If Yes, Then you are at the right place.

In this post, I’m going to do a detailed analysis of REC Ltd shares plus we will try to predict the share price of REC so that you can decide for yourself whether to invest in it or not.

As we know, REC Ltd is an Indian Infrastructure finance company which has good future potential. This share has given +525% returns from 2008 to 2023 and this return is continuously increasing year by year. But there is also a certain risk involved in this share, which we will discover in this post.

REC Share more details are available in this video –

REC Ltd Overview

REC Limited (Rural Electrification Corporation Limited) is a leading financial institution in Bharat. REC Limited was incorporated in 1969 as a public sector enterprise under the Ministry of Power, Government of Bharat. The company is primarily focused on the financing and promotion of rural electrification and power infrastructure projects.

Financial support is provided by REC Ltd by giving loans to power utilities, state governments, and other entities for the development of power generation, transmission, and distribution projects. One of the primary objectives is to make possible the electrification of rural and remote areas in Bharat by providing financial support for electrification projects in villages and small towns.

REC Ltd raises funds from various sources, including domestic and international financial institutions, bonds, and loans from multilateral agencies, to fund power infrastructure projects.

REC Financials

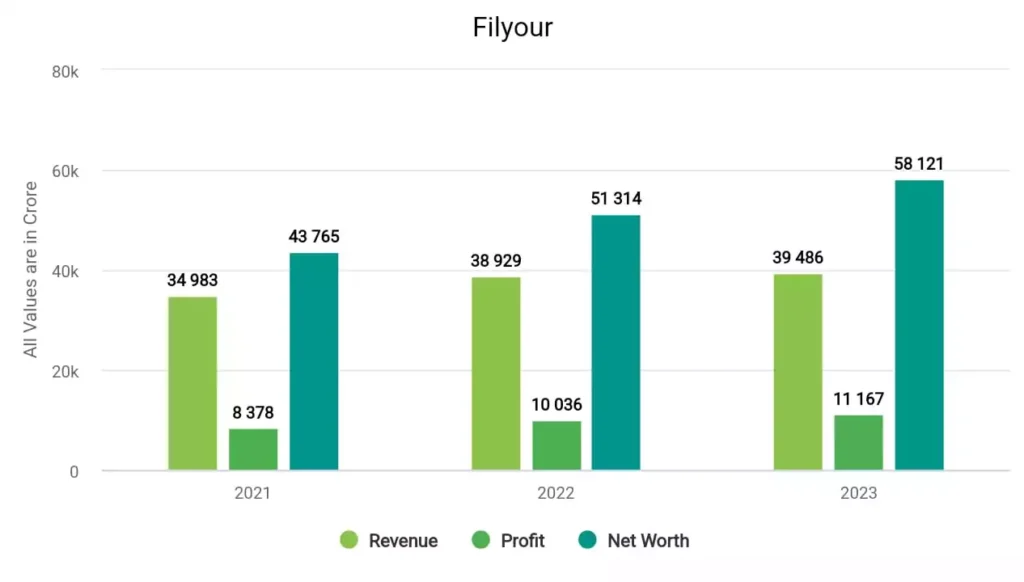

In 2021, the company’s revenue surged to ₹34,983 crore, and its profit was ₹8,378 crore. In 2022, the company made a profit of ₹10,036 crore with a revenue of ₹38,929 crore. In 2023, REC earned a profit of ₹11,167 crore and a revenue of ₹39,486 crore.

REC Fundamentals

| Market Cap. | ₹1,63,234 Crore |

| P/E ratio | 11,15 |

| Industry P/E | 19.64 |

| ROE | 20.07% |

| EPS | 55.59 |

| Book Value | 276.98 |

| Dividend Yield | 2.58% |

| Debt To Equity | 6.41 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹1,63,234 Crores, indicating that this is a sizable company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 11.15: The P/E ratio is a valuation metric that shows how much investors are willing to pay for each rupee of earnings. A P/E ratio of 11.15 indicates that investors are willing to pay ₹11.15 for every ₹1 of earnings per share (EPS).

- Industry P/E (Price-to-Earnings Ratio): 19.64: The industry’s average P/E ratio is 19.21. Comparing this to the company’s P/E of 9.64 suggests that the company’s stock may be trading at a lower valuation than the industry average.

- ROE (Return on Equity): 20.07%: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of 20.07% indicates that the company generated a profit of 20.07% for every rupee of shareholders’ equity. This is a positive ROE, although it is not exceptionally high.

- EPS (Earnings Per Share): ₹55.59: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company earned ₹55.59 for each outstanding share over a specific period.

- Book Value: ₹276.98: The book value per share is the company’s net asset value divided by the number of outstanding shares. In this case, it’s ₹276.98 per share.

- Dividend Yield: 2.58%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 2.58% suggests that the company pays a dividend equivalent to 2.58% of the stock’s value.

- Debt to Equity Ratio: 6.41: A ratio of 6.41 indicates that the company has 6.41 rupees in debt for every rupee of equity. This suggests a relatively high level of financial leverage, which can increase risk but can also be a sign of strategic borrowing for growth.

REC Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| REC Share Price Target 2023 | ₹621 | ₹644 |

| REC Share Price Target 2024 | ₹698 | ₹758 |

| REC Share Price Target 2025 | ₹793 | ₹809 |

| REC Share Price Target 2026 | ₹812 | ₹910 |

| REC Share Price Target 2027 | ₹959 | ₹1077 |

| REC Share Price Target 2028 | ₹1041 | ₹1433 |

| REC Share Price Target 2029 | ₹1167 | ₹1906 |

| REC Share Price Target 2030 | ₹1447 | ₹2535 |

REC Share Price Target 2024

REC share has performed well in the last 6 months and has given returns of +122% and in the last 1 year, it has given a return of +154%. The company share is performing well and it is predicted that REC Share Price Target 2024 can be INR 398 and the highest price can go up to INR 458.

REC Share Price Target 2025

The fundamentals of the REC company sound good and it is continuously improving. The ROE is 8.57% and the EPS of this share is 44.36 and the best part of this share is that it gives good dividends. Apart from being a good share, it also has some shortcomings, and one of the shortcomings of this share is that it has a lot of debt.

The Debt-to-Equity ratio of REC is 6.55, which is very high right? The share price target of REC in 2025 can be INR 493, and the highest price can go up to INR 609.

REC Share Price Target 2026

The financial trend of the company is also good because the profit of the company is continuously increasing. Similarly, the net worth and revenue are also increasing which is a good sign. By the way, the experts are predicting that REC Share Price Target 2025 will be INR 612 and the Highest price can be INR 810.

REC Share Price Target 2030

According to its past performance, it is predicted that REC Share Price Target 2030 will be INR 1447 and the highest price can go up to INR 2535. The Share can perform well in the long term as the company is expanding its business rapidly and it is forecasted that REC will 3 times its business by 2030.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about REC share price targets 2023, 2024, 2025, and 2030.

If you want to know anything else about it, then you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of REC Ltd?

The debt of REC Ltd is ₹ 4,19,517 Crore and its debt-to-equity ratio is 6.60.

What is the share price of REC in 2026?

The share price of REC in 2026 can be ₹612 while the highest price can be ₹810.

Also Read –

- HDIL Share Price Target

- BLS Infotech Share Price Target

- Alstone Textiles Share Price Target

- CG Power Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.