Vikas Lifecare Limited- Financials, Fundamentals, Detailed Stock Analysis, and Vikas Lifecare Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for a Vikas Lifecare Share Price Target, you are at the right place. In today’s article, we will discuss Vikas Lifecare’s Share Price Target.

As we know, Vikas Lifecare Limited is a penny stock but has performed well in the past few years. It has given a return of +108% from 2021 to 2023, which is an average return of +36%. Sounds good, right?

So mainly this article has been written to analyze the stock. And we will also try to find out the Vikas Lifecare Share Price Target in this. So, let’s first look at the company’s share overview, and its financial fundamentals, and then we will predict the future price of Infibeam Avenues shares.

Vikas Lifecare Overview

Vikas Lifecare Limited is a company who is known for its specialization in producing and supplying high-quality specialty chemicals to customers. Currently, Dr. S.K. Dhawan serves as the company’s Managing Director (MD). Their primary focus involves addressing significant environmental and safety concerns by developing innovative solutions.

Vikas Lifecare Limited specializes in the production and distribution of specialty chemicals. These chemicals are often unique and designed for specific applications across various industries.

Vikas Lifecare Limited leverages world-leading technology and chemical science to develop and manufacture its specialty chemicals. Continuous investments in research and development characterize the growth journey of Vikas Lifecare. This commitment to R&D indicates a proactive approach of the company to staying at the forefront of innovation in the specialty chemical industry.

Vikas Lifecare Financials

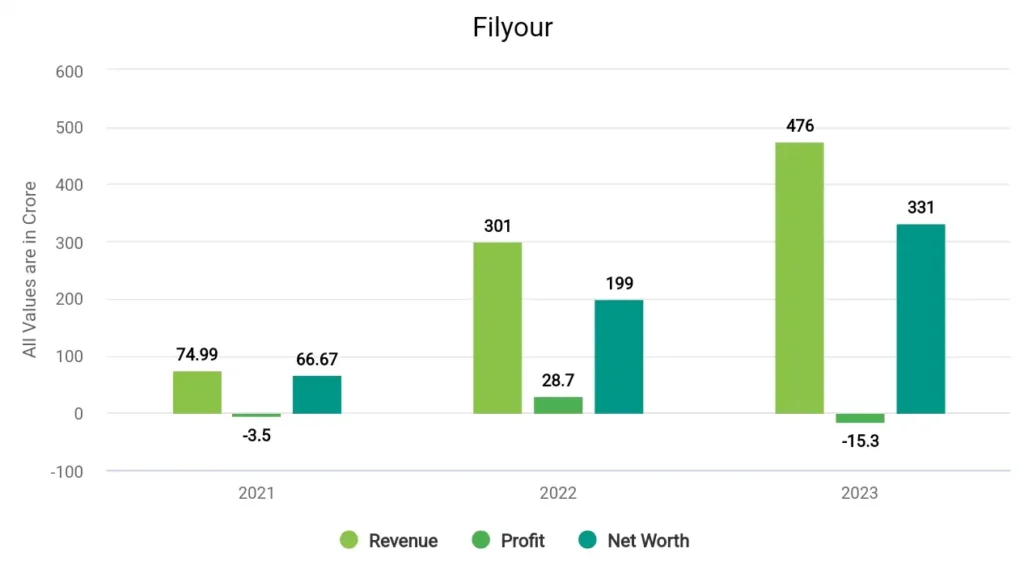

In 2021, the company’s revenue surged to ₹74.99 crore, and its profit was ₹-3.5 crore. In 2022, the company made a profit of ₹28.7 crore with a revenue of ₹301 crore. In 2023, Vikas Lifecare made a profit of ₹-15.5 crore and a revenue of ₹476 crore.

Vikas Lifecare Fundamentals

| Market Cap. | ₹735 Crore |

| P/E ratio | 0 |

| Industry P/E | 44.99 |

| ROE | -0.14% |

| EPS | -0.03 |

| Dividend Yield | 0% |

| Book Value | 3.03 |

| Debt to Equity | 0.011 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹735 Crores: Market capitalization represents the total market value of a company’s outstanding shares. In this case, it’s ₹735 Crores, indicating that this is a small to mid-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 0: A P/E ratio of 0 usually indicates that the company has reported negative earnings or no earnings. It’s important to investigate why the P/E is 0, as it can be due to various reasons, such as losses or recent IPOs.

- Industry P/E (Price-to-Earnings Ratio): 44.99: Comparing this to the company’s P/E of 0 suggests that the company might not be generating positive earnings or might be significantly underperforming the industry average in terms of profitability.

- ROE (Return on Equity): -.014%: ROE measures the company’s profitability relative to shareholders’ equity.

- EPS (Earnings Per Share): -0.03: An EPS of ₹-0.03 means that the company reports negative earnings per share for the period in question.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹3.03: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹3.03 per share.

- Debt to Equity Ratio: 0.11: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 0.11 indicates that the company has a relatively low level of debt compared to its equity.

Vikas Lifecare Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Vikas Lifecare Share Price Target 2024 | ₹6.96 | ₹7.34 |

| Vikas Lifecare Share Price Target 2025 | ₹7.80 | ₹8.44 |

| Vikas Lifecare Share Price Target 2026 | ₹8.73 | ₹9.71 |

| Vikas Lifecare Share Price Target 2027 | ₹9.78 | ₹11.16 |

| Vikas Lifecare Share Price Target 2028 | ₹10.95 | ₹12.84 |

| Vikas Lifecare Share Price Target 2029 | ₹12.27 | ₹14.76 |

| Vikas Lifecare Share Price Target 2030 | ₹13.74 | ₹16.98 |

Watch this video for more information –

Also Read – Rama Steel Share Price Target

Vikas Lifecare Share Price Target 2024

This share can give returns this year and it is expected that the share will go up by 20%. By the way, Vikas Lifecare has given returns of +58% in the last 6 months while +16% in the last 1 year. The experts forecasted that Vikas Lifecare Share Price Target for 2024 can reach INR 6.96 while the maximum price can go up to INR 7.34.

Vikas Lifecare Share Price Target 2025

The company’s fundamentals are quite bad due to which investors are hesitating before investing in it. It is common that if the fundamentals of a stock are bad then there will be hesitation in investing. And it is being seen that the fundamentals of the company are gradually getting worse, which is not considered good. Keeping these things in mind, it is predicted that Vikas Lifecare Share Price Target in 2025 can reach INR 7.80 and the highest price can go up to INR 8.44.

Vikas Lifecare Share Price Target 2026

Since the fundamentals of the share are worse along with this its financials also do not sound good. The company makes a profit of -15.3 crore which is not a good thing. By the way, by looking at its past performance it is concluded that Vikas Lifecare Share Price Target in 2026 will be INR 8.73 and the highest price can be INR 9.71.

Vikas Lifecare Share Price Target 2030

Vikash Lifecare’s Share Price Target for 2030 can reach INR 13.74 and the highest price can be INR 16.98. According to its historical data, it is suggested that the share price will lie between ₹13.74 – ₹16.98 by 2030.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Vikas Lifecare’s share price target for 2024, 2025, 2026, and 2030.

If you want to know anything else about it, then you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of Vikas Lifecare Share?

There is quite a possibility of getting multi-bagger returns from Vikas Lifecare shares in the future, But for this, you have to invest in this share wisely and for a long-term horizon.

Is Vikas Lifecare debt-free?

No, Vikas Lifecare has a debt of ₹ 61.4 Crore.

Also Read –

- REC Share Price Target

- Infibeam Avenue Share Price Target

- HDIL Share Price Target

- BLS Infotech Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.