Servotech Power Systems Ltd. – Financials, Fundamentals, Detailed Analysis, and Servotech Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

Are you looking for a Servotech Power Systems Share Price Target? If yes, then you are in the right place.

In this post, I will do a detailed analysis of Servotech Share plus we will forecast the share price of this share. So, consider this post a cue for your investment in Servotech Power share.

Hey, As we know this is a small-cap stock so before you invest in it I want to tell you that the stock has given +2,977% returns from 2021 – 2023, which sounds good right? But the question is, will this share provide the same returns in the long term? So, I will answer this type of question so stick to the end of this post.

Servotech Power Systems Overview

Servotech Power System Ltd is a company that’s making big changes in how we use energy in Bharat. Servotech is all about finding better ways to use energy. They have high-tech solar products and super-efficient EV chargers (those are for electric vehicles like cars and bikes). They’ve also made super-fast chargers for electric vehicles and chargers for homes, making it easier and quicker to charge electric vehicles.

- Their History: They started in 2004 by making inverters (devices that change the kind of electricity we use). Over time, they’ve grown a lot and even got listed on the stock market in 2017.

- Their Vision: Servotech’s big dream is to create solutions that reduce the impact of energy use on the environment. They want to stop relying on fossil fuels (like oil and gas) for the future.

- Their Mission: To achieve their dream, they’re committed to using advanced technology, sharing knowledge, and taking care of society and the environment.

Servotech Power Systems Financials

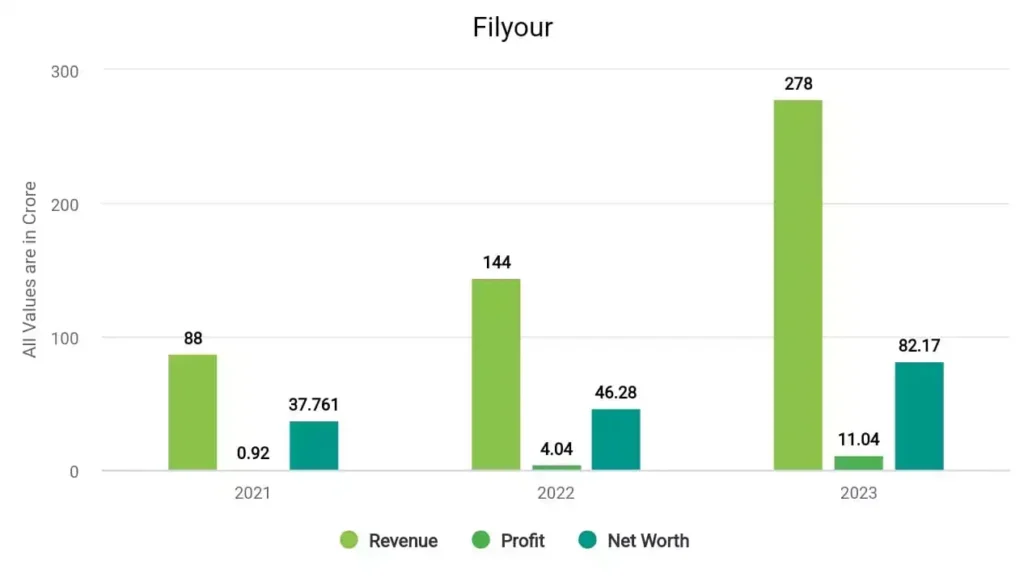

In 2021, the company’s revenue surged to ₹88 crore, and its profit was ₹0.92 crore. In 2022, the company made a profit of ₹4.04 crore with a revenue of ₹144 crore. In 2023, Servotech Power Systems made a profit of ₹11.04 crore and a revenue of ₹278 crore.

Servotech Power Systems Fundamentals

| Market Cap. | ₹4,193 crore |

| P/E ratio | 348.31 |

| Industry P/E | 115.39 |

| ROE | 8.29% |

| EPS | 0.54 |

| Book Value | 6.93 |

| Dividend Yield | 0.03% |

| Debt to Equity | 0.51 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹4,193 Crores: In this case, it’s ₹4,193 Crores, suggesting that this is a mid-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 348.31: A P/E ratio of 348.31 indicates that investors are willing to pay ₹348.31 for every ₹1 of earnings per share (EPS).

- Industry P/E (Price-to-Earnings Ratio): 115.39: The industry’s average P/E ratio is 115.39. Comparing this to the company’s P/E of 348.31 suggests that the company’s stock may be trading at a higher valuation than the industry average.

- ROE (Return on Equity): 8.29%: An ROE of 8.29% indicates that the company generated a profit of 8.29% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹0.54: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company earned ₹0.54 for each outstanding share over a specific period.

- Book Value: ₹6.93: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹6.93 per share.

- Dividend Yield: 0.03%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price.

- Debt to Equity Ratio: 0.51: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 0.51 indicates that the company has 51 paise in debt for every rupee of equity.

Servotech Power Systems Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Servotech Power Systems Share Price Target 2024 | ₹181.11 | ₹188.33 |

| Servotech Power Systems Share Price Target 2025 | ₹195.26 | ₹207.83 |

| Servotech Power Systems Share Price Target 2026 | ₹211.40 | ₹230.84 |

| Servotech Power Systems Share Price Target 2027 | ₹229.80 | ₹257.99 |

| Servotech Power Systems Share Price Target 2028 | ₹250.77 | ₹290.03 |

| Servotech Power Systems Share Price Target 2029 | ₹274.68 | ₹347.83 |

| Servotech Power Systems Share Price Target 2030 | ₹301.93 | ₹372.44 |

Servotech Power Systems Share more details are available in this video –

Servotech Power Systems Share Price Target 2024

This share has given incredible returns of +321% in the last 6 months while in the last year, it has given returns of +377%. But since then the stock has seen a significant decline, this stock fell by -9% last month. It is predicted that Servotech Share Price Target 2024 can be INR 181.11 and the highest price can go up to INR 188.33.

Servotech Power Systems Share Price Target 2025

The P/E ratio of the company is currently high at 108 because it has shown good growth in the past. The ROE of the company is 13% which is much more than the returns of a bank FD. So fundamentally, this company is neither good nor bad, we can say it is average. By the way, the experts are predicting that Servotech Share Price Target 2025 can be INR 195.26 and the highest price can be INR 207.83.

Servotech Power Systems Share Price Target 2026

The company is financially good, and the profit of the company is going up which is a good sign. Looking at its Revenue and Net Worth, it is also growing however its revenue is increased by 100% from 2022 to 2023. Looking at its past performance, it is concluded that Servotech Share Price Target 2026 will be INR 211.40 and the highest price can go up to INR 230.84.

Servotech Power Systems Share Price Target 2030

Its historical data says the lowest and highest Servotech Power Systems Share Price Target 2030 can be INR 301.93 and INR 372.44 respectively.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Servotech Power Systems share price target 2023, 2024, 2025, 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Servotech Power Systems company?

The debt of Servotech Power Systems company is₹ 42.3 crore and its debt-to-equity ratio is 0.53.

What is the share price of Servotech Power Systems in 2025?

The share price of Servotech Power Systems in 2025 can be ₹195,26 while the highest price can be ₹207.83.

Also Read –