Airan Ltd: Financials, Fundamentals, Detailed Analysis, and Airan Share Price Target (2023, 2024, 2025, 2026, 2027, 2028, 2029, 2030).

In today’s post, we will know about Airan Share Price Target, and we will also do a detailed analysis of this share.

Airan Ltd is a penny stock and the best thing about this share is it has given massive returns in recent years. If we look at its returns, it has given a return of +384% from 2017 to 2023, which is an average return of +64% every year.

Some experts forecast that this share will give multi-bagger returns in the coming years. So How much it will be true, we will know in the Airan Share Price Target post.

Airan Overview

Airan Ltd is a dynamic IT and IT-enabled services company with a history from the 1990s. Founded as Arrow Computer Systems (ACS), it started with computer coaching classes and has since expanded its services to include Banking transaction processing and Document management for various sectors. Their commitment to technology, domain expertise, and nationwide presence make them a significant player in the industry.

One of Airan’s key milestones was pioneering IPO application and MICR Clearing processing in Western India. They also ventured into Cash Management Services and collaborated with Citibank NA for clearing operations. With a focus on innovation and quality, Airan remains at the forefront of technology-driven services.

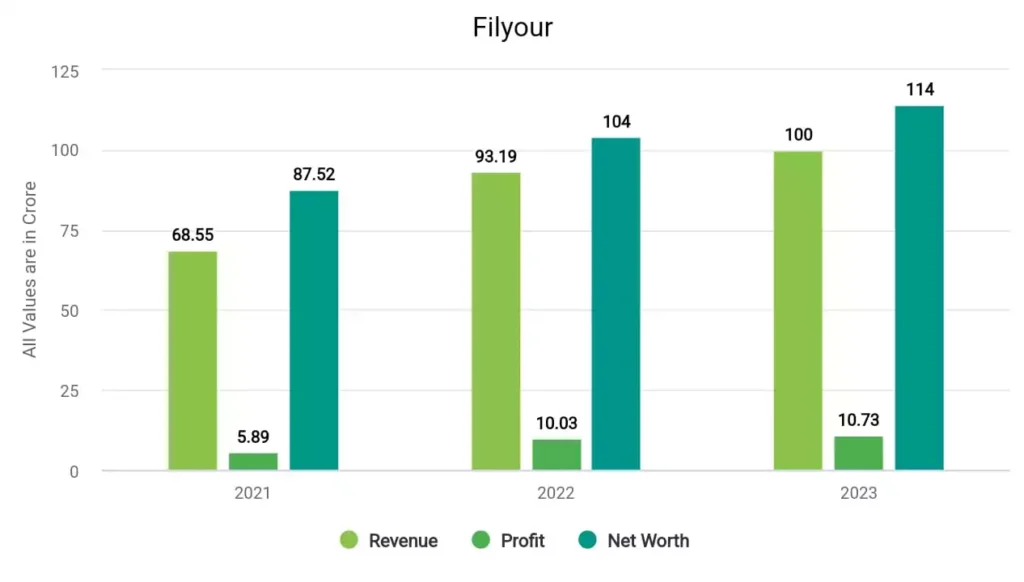

Airan Financials Trends

In 2021, the company’s revenue surged to ₹68.55 crores, and its profit was 5.89 crore. In 2022, the company made a profit of 10.03 crore with a revenue of ₹93.19 crore. In 2023, Airan earned a strong profit of 10.73 crore and a revenue of ₹100 crore.

Airan Fundamentals

| Market Cap. | ₹367 crore |

| P/E ratio | 29.38 |

| Industry P/E | 32.30 |

| ROE | 9.96% |

| EPS | 1 |

| Book Value | 10.08 |

| Dividend Yield | 0% |

| Debt to Equity | 0.01 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹367 Crores: ₹367 Crores, suggesting that this is a small-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 29.38: A P/E ratio of 29.38 indicates that investors are willing to pay ₹29.38 for every ₹1 of earnings per share (EPS). It suggests that the company’s stock is trading at a moderate valuation compared to its earnings.

- Industry P/E (Price-to-Earnings Ratio): 32.30: The industry’s average P/E ratio is 32.30. Comparing this to the company’s P/E of 29.38 suggests that the company’s stock may be trading at a slightly higher valuation than the industry average.

- ROE (Return on Equity): 9.96%: An ROE of 9.96% indicates that the company generated a profit of 9.96% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹1: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock.

- Book Value: ₹10.08: The book value per share is the company’s net asset value divided by the number of outstanding shares. In this case, it’s ₹10.08 per share.

- Dividend Yield: 0%: A dividend yield of 0% suggests that the company did not pay dividends during the period.

- Debt to Equity Ratio: 0.01: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 0.01 indicates that the company has 1 paise in debt for every rupee of equity.

Airan Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Airan Share Price Target 2023 | ₹27.44 | ₹28.17 |

| Airan Share Price Target 2024 | ₹30.73 | ₹32.40 |

| Airan Share Price Target 2025 | ₹34.42 | ₹37.26 |

| Airan Share Price Target 2026 | ₹38.55 | ₹42.85 |

| Airan Share Price Target 2027 | ₹43.18 | ₹49.28 |

| Airan Share Price Target 2028 | ₹48.36 | ₹56.67 |

| Airan Share Price Target 2029 | ₹54.16 | ₹65.17 |

| Airan Share Price Target 2030 | ₹60.66 | ₹74.95 |

Airan Share more details are available in this video –

Airan Share Price Target 2024

The management of the company is taking steps to advance IT sector solutions which will help the company to tackle lots of upcoming problems. Since the company is fundamentally strong, the debt of this company is also very low. Analysts are predicting that the lowest Airan Share price in 2024 can be INR 30.73 and the highest price can go up to INR 32.40.

Airan Share Price Target 2025

INR 34.42 can be the lowest Airan Share Price Target 2025 and the highest price can be INR 37.26. The experts have forecasted this share price based on its past performance and it is expected that if the company makes some changes in its management then it can affect this share price. Well, the expected price will range between 40% to 60% of its current share price which is INR 23.

Airan Share Price Target 2030

Analysts have forecasted that the lowest Airan Share Price Target 2030 can be INR 60.66 with the potential for a further rise to INR 74.95. The fundamentals and financials of this company are strong and in the long term, it will perform well as its historical data are quite good.

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Airan’s share price targets for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Airan company?

The debt of Airan company is ₹ 0.76 Crore and its debt-to-equity ratio is 0.01.

What is the share price of Airan in 2025?

The share price of Airan in 2025 can be ₹34.42 while the highest price can be ₹37.26.

Also Read –

- Evexia Lifecare Share Price Target

- Dwarikesh Sugar Share Price Target

- BLS Infotech Share Price Target

- Adcon Capital Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.