IDFC First Bank Ltd – Fundamentals, Financials, Detailed Analysis, and IDFC First Bank Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

IDFC First Bank Share has given a return of +225% from Sep 2020 to Sep 2023. That is an average return of +75% which is a multi-bagger return from the stock. Due to this, the stock is in high demand and attracting retail investors to invest in it.

And if you are also going to invest in it, then today we will know what you need to remember while investing in IDFC First Bank, through this article. Since this is a banking sector stock, And as India develops, there will be a need for loans and in this situation, the banking sector will be seen playing a vital role.

So the question is, Will this stock continue to grow like this in the future? Or Whether we will see a decline in this stock? Today we will answer all these questions in this post and will also forecast IDFC First Bank’s Share Price Target.

IDFC First Bank Overview

IDFC First Bank is a prominent banking institution in Bharat that was formed after the merger of IDFC Bank and Capital First in December 2018. With a diversification of financial services, the bank caters to various customer segments, including retail, small and medium enterprises (SMEs), and wholesale customers.

This bank is currently managed by V. Vaidyanathan, who previously headed ICICI Prudential Life Insurance. As we know he has taken ICICI Bank to the top, People are expecting something similar from IDFC First Bank and it is being said that this will be the second ICICI Bank in the coming days.

IDFC First Bank provides a wide range of banking solutions like savings and current accounts, recurring and fixed deposits, home, business, and personal loans as well as credit cards. Additionally, the bank also offers various financial products such as mutual funds, insurance, and wealth management services.

IDFC First Bank Fundamentals

| Market Cap. | ₹55,388 Crore |

| P/E ratio | 19.39 |

| ROE | 7.79% |

| EPS | 3.82 |

| Dividend Yield | 0% |

| Book Value | 49 |

| Debt | ₹ 2,51,506Cr. |

| Debt to Equity | 7.79 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹55,388 Crores: Market capitalization represents the total market value of a company’s outstanding shares. In this case, it’s ₹55,388 Crores, indicating that this is a large-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 19.39: A P/E ratio of 19.39 indicates that investors are willing to pay ₹19.39 for every ₹1 of earnings per share (EPS). It suggests that the company’s stock is trading at a moderate valuation compared to its earnings.

- ROE (Return on Equity): 7.79%: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of 7.79% indicates that the company generated a profit of 7.79% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹3.82: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company earned ₹3.82 for each outstanding share over a specific period.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹49: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹49 per share.

- Debt: ₹2,51,506 Crores: The total debt held by the company is ₹2,51,506 Crores.

- Debt to Equity Ratio: 7.79: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 7.79 indicates that the company has ₹7.79 in debt for every rupee of equity.

Also Read –

IDFC First Bank Financials

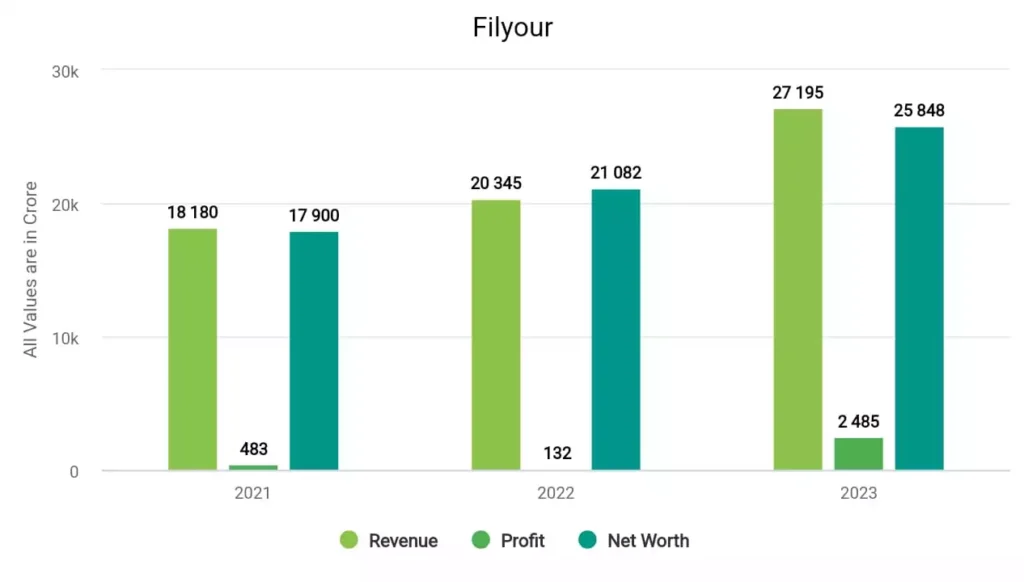

In 2021, the company’s revenue surged to ₹18,180 crore, and its profit was ₹483 crore. In 2022, the company made a profit of ₹132 crore with a revenue of ₹20,345 crore. In 2023, IDFC Bank made a profit of ₹2,485 crore and a revenue of ₹27,195 crore.

IDFC First Bank Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| IDFC First Bank Share Price Target 2024 | ₹98.76 | ₹102.88 |

| IDFC First Bank Share Price Target 2025 | ₹142.21 | ₹160.74 |

| IDFC First Bank Share Price Target 2026 | ₹170.66 | ₹200.93 |

| IDFC First Bank Share Price Target 2027 | ₹204.79 | ₹251.16 |

| IDFC First Bank Share Price Target 2028 | ₹245.75 | ₹313.95 |

| IDFC First Bank Share Price Target 2029 | ₹294.90 | ₹392.44 |

| IDFC First Bank Share Price Target 2030 | ₹353.87 | ₹490.55 |

More details of IDFC First Bank are available in this video –

IDFC First Bank Share Price Target 2024

The share has given returns of +44% in the past 1 year and +30% in the past 6 months. If we see its all-time returns that is November 2015 and November 2023, then it is +17%, which is not so good. The experts are expecting 15% – 18% returns from this share. That means IDFC First Bank Share Price Target 2023 can be INR 98.76 and the highest price can be INR 102.88.

IDFC First Bank Share Price Target 2025

The lowest and highest IDFC First Bank Share Price Target 2025 can be INR 142.21 and the highest price can be INR 160.74. Since 2018, the bank has turned into profitable which is good. From those years the bank has continuously made profits even in 2023, IDFC First Bank made a profit of ₹2485 crore and its revenue and net worth are also growing well.

IDFC First Bank Share Price Target 2030

The experts forecast that IDFC First Bank can perform well in the long term. According to its historical data, it is concluded that IDFC First Bank Share Price Target 2030 can be INR 353.87 while the highest price can be INR 490.55. This share price prediction has been forecasted by taking into account its past performance, historical data, and its fundamentals. So don’t consider it direct advice for your investment.

What is the Future of IDFC First Bank Share?

The CEO and MD of IDFC First Bank V. Vaidyanathan is running the bank effectively & efficiently. According to the current scenario, the future of this bank is said to be very good and there are a lot of chances of getting good profits in the future.

But when the MD of the bank is changed then we will have to analyze this bank again. Since the backbone of any bank is its management, and as we know Vaidyanthan is considered the king of retail banking due to which this bank is growing.

Currently, this bank is focusing more on retail banking, due to which a good change has been seen in its profits. Another advantage of retail banking is that the chances of default are much less. Anyway, the bank is good, its management is good, So there are a lot of chances that the future will also be good.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

The IDFC First Bank share can give multi-bagger returns but there is something concerning for this stock that will affect the share price. As we analyze the stock that has given good returns in the past, there is also the possibility of getting good returns.

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about IDFC First Bank’s share price target for 2023, 2024, 2025, and 2030. If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of IDFC First Bank company?

The debt of IDFC First Bank company is ₹ 2,51,506 crore that’s why its debt-to-equity ratio is 7.79.

What will be the share price target of IDFC First Bank for 2040?

The lowest and highest share price target of IDFC First Bank for 2024 will be INR 1280 and INR 1500.

Also Read –