Olectra Greentech Share Price Target from 2024 – 2030 (Stock Analysis of Olectra Greentech Limited, Fundamentals, Financials, Future Plans and more)

In this post, we will do a detailed analysis of Olectra Greentech stock, so you can decide yourself whether to invest in it or not.

As we know, Olectra Greentech is a mid-cap stock that has comparatively lower risk than low-risk stock. So before investing in this share, let’s analyze the share so it becomes easy for you to judge this stock.

Before diving into the post, let me tell you that currently the stock of Olectra greentech is overvalued. So, it will be best for you to consult a stock advisor before investing in this share.

Olectra Greentech Overview

Olectra Greentech Limited which is headquartered in Hyderabad, stands as the country’s foremost pure electric bus manufacturer. The impressive track record of Olectra proudly holds the distinction of being India’s inaugural electric bus manufacturer.

The company is successfully producing and deploying an extensive range of electric bus variants across the nation. Notably, the company has made significant strides in the commercialization of electric buses, and its innovative endeavors now extend to encompass electric trucks and tippers in the e-mobility segment.

Distinguishing itself as a publicly listed entity, Olectra’s shares are traded on the esteemed Bombay Stock Exchange (BSE) as well as the National Stock Exchange (NSE), underscoring its market presence and credibility.

Olectra Greentech Financial

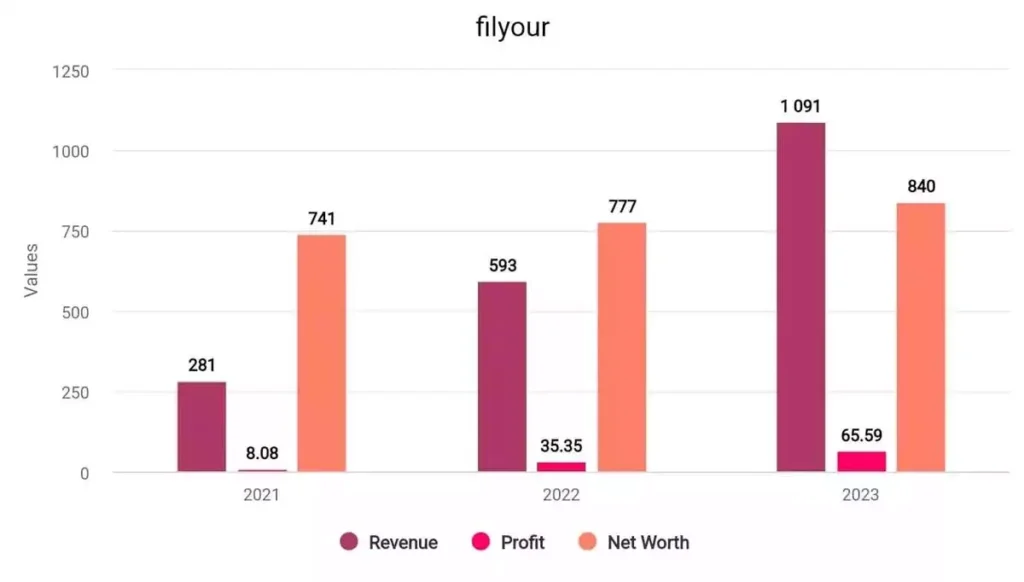

In 2021, the company’s revenue surged to 281 crore, and its profit was 8.08 crore. In 2022, the company made a profit of 35.35 crore with a revenue of 593 crore. And in 2023, Olectra earned a strong profit of 65.59 crore and a revenue of 1091 crore.

Olectra Greentech Fundamentals

| Share | Olectra Greentech |

|---|---|

| Market Cap. | ₹ 13,090 Cr. |

| P/E ratio | 158.21 |

| Industry P/E | 23.29 |

| ROE | 8.41% |

| EPS | 10.08 |

| Book Value | 111.29 |

| Debt to Equity | 0.13 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹13,090 Crores: This indicates that this is a mid-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 158.21: A P/E ratio of 158.21 indicates that investors are willing to pay ₹158.21 for every ₹1 of earnings per share (EPS).

- Industry P/E (Price-to-Earnings Ratio): 23.29: The industry’s average P/E ratio is 23.29. Comparing this to the company’s P/E of 158.21 suggests that the company’s stock is trading at a significantly higher valuation than the industry average.

- ROE (Return on Equity): 8.41%: An ROE of 8.41% indicates that the company generated a profit of 8.88% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹10.08: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock.

- Book Value: ₹111.29: The book value per share is the company’s net asset value divided by the number of outstanding shares. In this case, it’s ₹111.29 per share.

- Debt to Equity Ratio: 0.13: A ratio of 0.13 indicates that the company has 0.13 rupees in debt for every rupee of equity.

Olectra Greentech Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Olectra Greentech Share Price Target 2023 | ₹1300 | ₹1500 |

| Olectra Greentech Share Price Target 2024 | ₹1800 | ₹2100 |

| Olectra Greentech Share Price Target 2025 | ₹2700 | ₹3200 |

| Olectra Greentech Share Price Target 2026 | ₹3900 | ₹4400 |

| Olectra Greentech Share Price Target 2027 | ₹5200 | ₹6000 |

| Olectra Greentech Share Price Target 2028 | ₹7450 | ₹8050 |

| Olectra Greentech Share Price Target 2029 | ₹9500 | ₹10200 |

| Olectra Greentech Share Price Target 2030 | ₹12000 | ₹14000 |

For more details about the Olectra Greentech Share, you can watch this video –

Olectra Greentech Share Price Target 2023

The company seems to be growing fast by the experts are speculating that it can give almost good returns in 2023. According to the current scenario, experts are predicting that Olectra Greentech Share Price Target 2023 can be INR 1500, and the highest price can be INR 1800.

As we can see, the stock has risen by +140% in 6 months while in 1 year, it has given returns of +91%. Investors are expecting the same returns on their investment But this will happen when the company again gets a big order, which is the possibility.

Olectra Greentech Share Price Target 2024

Companies working in the EV sector have a promising future. People are excited about developing, purchasing, and adopting EVs. The number of electric vehicles on the roads is increasing rapidly, and in the coming times, the importance of electric vehicles will increase in the future. Regarding Olectra Greentech Share Price Target for 2024, the first target could be around 2100, and the second target might extend up to 2400.

Olectra Greentech Share Price Target 2025

The fundamentals of this company are almost good, as the ROE is 8.11% and EPS is 8.15, which is almost okay. Because it is a mid-cap stock, the stock will grow in the future and can even give multi-bagger returns in the future. The experts are predicting that Olectra Greentech Share Price Target 2025 can be INR 2700 while the highest price can be INR 3200.

Olectra Greentech Share Price Target 2030

In its latest bus models, the company has introduced numerous features that outshine those offered by its competitors. Notably, the fast charging capability of these buses sets them apart. With this rapid charging functionality, covering long distances becomes feasible in just two hours of charging time. The company is continually incorporating various technologies to enhance its offerings.

Regarding Olectra Greentech Share Price Target 2025, it’s anticipated to reach INR 12,000 as a primary target. Furthermore, considering other factors, the share price could potentially ascend to approximately INR 14,000.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

This is all about the Olectra Greentech share. I hope you like knowing about Olectra Greentech Share Price Target and you can decide yourself whether to invest in it or not. And yes, do not invest in the share just by looking share price target, consult an advisor or do thorough research before investing in any share.

If you want to know anything else about it, then you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Olectra Greentech company?

The debt of Olectra Greentech company is ₹131 crore and its debt-to-equity ratio is 0.15.

What is the share price of Olectra Greentech in 2025?

The share price of Olectra Greentech in 2025 can be ₹2700 while the highest price can be ₹3200.

Also Read –

- Infibeam Avenues Share Price Target

- GMDC Share Price Target

- RVNL Share Price Target

- CG Power Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.