Alok Industries Ltd. Fundamentals, Financials, Future Performances. Alok Industries Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for Alok Industries Share Price Target, then you are at the right place. Since this is a penny stock so, investing in it is a bit risky.

But if we see its last one-year returns, which is +147%, that is massive, right? So the question is Is Alok Industries Stock worth investing in? Or Will this share give good returns in the long term? We will answer all these questions in this post.

So, let’s look at the businesses of Alok Industries and then we will do its fundamental analysis. And after that, we will try to forecast the Alok Industries share price target. So, let’s dive into the post.

Alok Industries Overview

Alok Industries Limited is headquartered in Mumbai which is owned by Reliance Industries and is a leading player in the Indian textile manufacturing sector. Operating as one of the largest vertically integrated companies in the country, Alok Industries covers multiple divisions including Home Textiles, Cotton Yarn, Apparel Fabrics, Garments, Technical Textiles, Textile Accessories, and Polyester Yarn.

Alok Industries is recognized for its sustainability efforts and product quality, holding certifications such as Global Organic Textiles (GOTS), OEKOTEX, Made in Green, Fairtrade, and Egyptian Cotton. The company adheres to international standards including ISO 9001, Environmental Management System (ISO 18001), Occupational Health and Safety System (OHSAS 45001), Made in Green – Step Certification, and OKEOTEX 100.

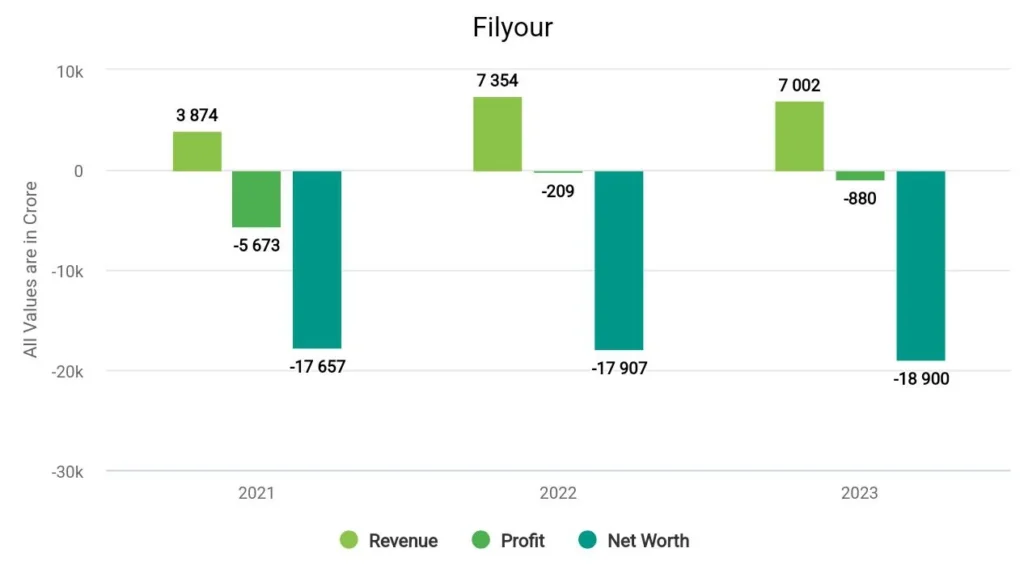

Alok Industries Financials

In 2021, the company’s revenue surged to ₹3,874 crore, and its profit was ₹-5,673 crore. In 2022, the company made a profit of ₹-209 crore with a revenue of ₹7,354 crore. In 2023, Alok Industries earned a profit of ₹-880 crore and a revenue of ₹7002 crore.

Alok Industries Fundamentals

| Market Cap. | ₹14,037 Cr |

| P/E Ratio | -16.93 |

| Industry P/E | 31.59 |

| EPS | -1.67 |

| ROE | 4.28% |

| Dividend Yield | 0% |

| Book Value | -39.83 |

| Debt to Equity | -1.32 |

Matrics Explained –

- Market Cap (Market Capitalization): ₹14,037 Crore: Indicating that this is a mid-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): -16.93: A P/E ratio of -16.93 indicates that the company reported negative earnings, making the P/E ratio undefined or not applicable.

- Industry P/E (Price-to-Earnings Ratio): 31.59: The industry’s average P/E ratio is 31.59. Comparing this to the company’s P/E (which is -16.93 due to negative earnings) suggests that the company may not perform as well as the industry average regarding profitability.

- EPS (Earnings Per Share): -1.67: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company reported a loss of ₹-1.67 for each outstanding share over a specific period.

- ROE (Return on Equity): 4.28%: An ROE of 4.91% indicates that the company generated a profit of 4.28% for every rupee of shareholders’ equity.

- Dividend Yield: 0%: A dividend yield of 0% suggests that the company did not pay dividends during the period.

- Book Value: -39.83: The book value per share is the company’s net asset value divided by the number of outstanding shares. In this case, it’s -₹39.83 per share, indicating a negative book value.

- Debt to Equity Ratio: -1.32: The debt-to-equity ratio measures a company’s financial leverage. A ratio of -1.32 indicates a negative equity position, which could result from the reported negative book value.

Alok Industries Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Alok Industries Share Price Target 2024 | ₹35.57 | ₹37.13 |

| Alok Industries Share Price Target 2025 | ₹40.55 | ₹44.18 |

| Alok Industries Share Price Target 2026 | ₹46.22 | ₹52.58 |

| Alok Industries Share Price Target 2027 | ₹52.70 | ₹62.57 |

| Alok Industries Share Price Target 2028 | ₹60.07 | ₹74.45 |

| Alok Industries Share Price Target 2029 | ₹68.48 | ₹88.60 |

| Alok Industries Share Price Target 2030 | ₹78.07 | ₹105.43 |

| Alok Industries Share Price Target 2040 | ₹89.01 | ₹125.47 |

Alok Industries Share Price Target 2024

The returns of Alok Industries in the last 1 year was 141% while in the last 6 months, the return was +105%, which is quite good. The experts are forecasting that this stock will give good returns in 2023. That is, Alok Industries Share Price Target 2024 can be INR 35 while the highest price can be INR 37.

Alok Industries Share Price Target 2025

The fundamentals of Alok Industries shares are also almost good, but its P/E ratio is currently much higher than its Industry P/E. The ROE of the share is 4.19% while EPS is -1.87, which is bad as per its share price. But the company has lots of debt which is quite concerning for the company. By the way, the lowest Alok Industries Share Price Target 2025 can be INR 40.55 while the highest price can go up to INR 44.18.

Alok Industries Share Price Target 2030

Rally can be seen in this stock in 2030 as it is growing very fast. As we can see, it has given returns of +105% in the last 6 months to date. That is, on average it has given returns of 10% every month. And we expect this stock to give returns of up to 23% this year. That’s why, Alok Industries Share Price Target 2030 will be INR 78 and the maximum price can go up to INR 105, which is a good return.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, Please tell by commenting. We have tried to know as much as possible about Alok Industries Share Price Target 2024, 2025, 2026, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of Alok Industries Share?

There is very little possibility of getting multi-bagger returns from Alok Industries shares in the future. But for this, you have to invest in Alok Industries share wisely and for a long-term horizon.

Is Alok Industries debt-free?

No, Alok Industries has a debt of ₹ 23,900 Crore.

Also Read –