Are you looking for an ARC Finance Share Price Target? If yes, then you are at the right place. In this post, we will talk about ARC Finance Share Price Target plus we will also do a detailed analysis of the share.

So, before analyzing the share I want to tell you that, ARC Finance is a small-cap penny stock, which carries high rewards with very high risk. The share has given a return of -41% from 2016 to 2023 which is not considered good.

The fundamentals and financials of ARC Finance are good but it is the only factor that determines the future price of shares. So, let’s dive into the post and analyze the share and ARC Finance Share Price Target so you can decide whether to invest in it or not.

ARC Finance Overview

ARC Finance i.e. Asset Reconstruction Company Finance is a financial institution that specializes in the acquisition and resolution of non-performing assets (NPAs) from banks and financial institutions. These NPAs typically consist of loans and other assets that have turned bad or are at risk of default.

The primary objective of ARC Finance is to help banks and financial institutions maintain their balance sheets by purchasing distressed assets. Once acquired, the company works on recovering value from these assets through various means, such as restructuring, selling, or liquidating them.

The proceeds generated from the resolution of these assets are shared between ARC Finance and the selling institution. ARC Finance contributes to the overall stability and health of the financial system by taking over and efficiently managing distressed assets,

ARC Finance Financials

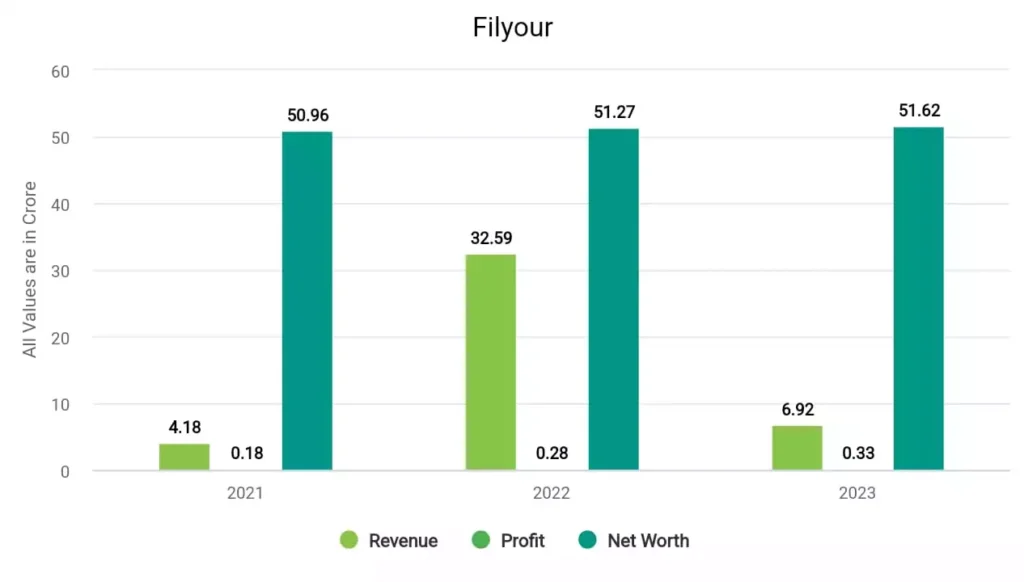

In 2021, the company’s revenue surged to 4.18 crore, and its profit was 0.18 crore. In 2022, the company made a profit of 0.28 crore with a revenue of 32.59 crore. In 2023, ARC Finance earned a profit of 0.33 crore and a revenue of 6.92 crore.

ARC Finance Fundamentals

| Market Cap | ₹238 Cr |

| P/E ratio | 37 |

| Industry P/E | 25 |

| ROE | 11.15 % |

| EPS | 0.07 |

| Dividend Yield | 0% |

| Book Value | 1.17 |

| Debt to Equity | 0.31 |

Metrics Details –

- Market Cap (Market Capitalization): ₹238 Crores: The market capitalization is the total market value of the company’s outstanding shares. In this case, it’s ₹238 Crores, which suggests that this is a relatively small-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 37 : A P/E ratio of 37 usually indicates that the company is trading at a good price.

- Industry P/E (Price-to-Earnings Ratio): 25: The industry’s average P/E ratio is 25. Comparing this to the company’s P/E of 37 suggests that the company is higher than its industry P/E.

- ROE (Return on Equity): 11.15%: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of 11.15% indicates that the company generated a profit of 11.15% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹0.07: An EPS of ₹0.07 means that the company did not report any earnings per share for the period in question.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹1.17: The book value per share is the company’s net asset value divided by the number of outstanding shares. In this case, it’s ₹1.17 per share.

- Debt to Equity Ratio: 0.31: The debt-to-equity ratio is a measure of financial leverage. A ratio of 0.31 indicates that the company has 31 paise in debt for every rupee of equity. This suggests a relatively conservative level of debt.

ARC Finance Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| ARC Finance Share Price Target 2023 | ₹1.77 | ₹1.79 |

| ARC Finance Share Price Target 2024 | ₹2.80 | ₹2.85 |

| ARC Finance Share Price Target 2025 | ₹2.85 | ₹2.92 |

| ARC Finance Share Price Target 2026 | ₹2.89 | ₹2.99 |

| ARC Finance Share Price Target 2027 | ₹2.93 | ₹3.07 |

| ARC Finance Share Price Target 2028 | ₹2.98 | ₹3.16 |

| ARC Finance Share Price Target 2029 | ₹3.03 | ₹3.25 |

| ARC Finance Share Price Target 2030 | ₹3.13 | ₹3.35 |

ARC Finance Share Price Target 2023

As we know, this is a penny share and has given a very poor return in past years. The share has given returns of 7% in the last 6 months while in the last 1 year, the share has given returns of -27%, which is not good at all. Considering these, ARC Finance Share Price Target 2023 can be INR 1.77 while the highest price can go up to INR 1.79.

ARC Finance Share Price Target 2024

ARC Finance appears to have solid fundamentals, although its ROE and EPS are relatively low and not considered favorable. Unfortunately, the share’s P/E ratio is 0, which suggests that there may be a lack of investor interest. The Experts predict that ARC Finance Share Price Target 2024 can be INR 2.80 and the highest price can go up to INR 2.85.

ARC Finance Share Price Target 2025

Similarly, the ARC Finance Share Price Target 2025 can be INR 2.85 while the highest price can be INR 2.92. As we can see, the financial trends are good as the company profit is increasing significantly and the net worth and revenue are growing well.

ARC Finance Share Price Target 2030

The company is making significant efforts to increase the business but currently, this stock will not be a good recommendation for the people who want to play it safe. According to its historical data, it is forecasted that ARC Finance Share Price Target 2030 will be INR 3.13 and the highest price can be INR 3.35.

Conclusion

So how did you like this blog, Please tell by commenting. We have tried to know as much as possible about ARC Finance Share Price Target 2024, 2025, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of ARC Finance Share?

There is quite a possibility of getting multi-bagger returns from ARC Finance share in the future. But for this, you have to invest in ARC share wisely and for a long-term horizon.

Is ARC Finance debt-free?

No, ARC Finance has a debt of ₹ 16.1 Crore.

Also Read –

- Infibeam Share Price Target

- RVNL Share Price Target

- Dwarikesh Sugar Share Price Target

- Future Consumer Share Price Target

- Gromo App Review

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.