Evexia Lifecare Ltd – Financials, Fundamentals, Detailed Analysis, and Evexia Lifecare Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

Are you looking for Evexia Lifecare Share Price Target? If yes, then you are at the right place. In this post, we will do a detailed analysis of this share, Additionally, we will also forecast its share price.

Evexia Lifecare is a penny stock, so this share may be quite risky for investment. If we see its max returns from 2012 to 2023, then it is -42%, which is not good. Just like its returns, The fundamentals and its financial conditions are also bad, So can this be a good investment?

No right. But many so-called investors say that this share will make you rich in the future, which makes no sense. So, will Evexia share give good returns in the future? or Will this share make you rich in the future? We will know the answer to all of these questions in this post.

Evexia Lifecare Overview

Evexia Lifecare Limited is a diversified company with wide-ranging business interests. They’re known for producing high-quality edible oils and maintaining safety and quality norms. also, the company plays an important part in the growing electric vehicle industry, contributing to sustainable transportation results.

Evexia Lifecare is also actively involved in manufacturing plastic grains, which are used in industries similar to packaging and construction, and they deliver essential lubricants for various machinery spanning the automotive and artificial sectors. also, the company engages in gold and diamond trading, which is full of historical significance. They also provide expertise in software development.

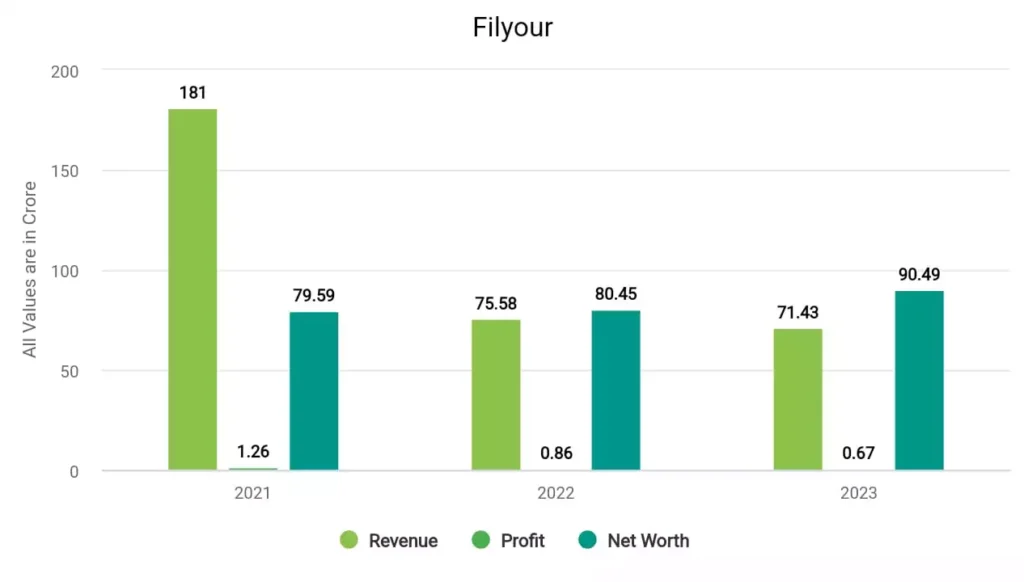

Evexia Lifecare Financials

In 2021, the company’s revenue surged to ₹181 crore, and its profit was ₹1.26 crore. In 2022, the company made a profit of ₹0.86 crore with a revenue of ₹75.58 crore. In 2023, Evexia Lifecare made a profit of ₹0.67 crore and a revenue of ₹71.43 crore.

Evexia Lifecare Fundamentals

| Market Cap. | ₹360 crore |

| P/E ratio | 322 |

| Industry P/E | 55.82 |

| ROE | 1.06% |

| EPS | 0.01 |

| Dividend Yield | 0% |

| Book Value | 2.06 |

| Debt to Equity | 5.30 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹360Crores: ₹360 Crores, indicating that this is a small-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 322: The P/E ratio is a valuation metric that shows how much investors are willing to pay for each rupee of earnings.

- Industry P/E (Price-to-Earnings Ratio): 55.82: The industry’s average P/E ratio is 55.82. Comparing this to the company’s P/E (which is 322 due to low earnings) suggests that the company may not be performing as well as the industry average in terms of profitability.

- ROE (Return on Equity): 1.06%: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of 1.06% indicates that the company experienced a negative return on equity, meaning it did not generate a profit relative to its equity during the period.

- EPS (Earnings Per Share): 0.01: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock.

- Dividend Yield: 0%: A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹2.06: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹2.06 per share.

- Debt to Equity Ratio: 5.30: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 5.30 indicates that the company has 5.30 rupees in debt for every rupee of equity.

Evexia Lifecare Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Evexia Lifecare Share Price Target 2023 | ₹1.87 | ₹1.91 |

| Evexia Lifecare Share Price Target 2024 | ₹1.93 | ₹2.01 |

| Evexia Lifecare Share Price Target 2025 | ₹1.99 | ₹2.11 |

| Evexia Lifecare Share Price Target 2026 | ₹2.05 | ₹2.21 |

| Evexia Lifecare Share Price Target 2027 | ₹2.11 | ₹2.32 |

| Evexia Lifecare Share Price Target 2028 | ₹2.17 | ₹2.44 |

| Evexia Lifecare Share Price Target 2029 | ₹2.24 | ₹2.56 |

| Evexia Lifecare Share Price Target 2030 | ₹2.31 | ₹2.69 |

Evexia Lifecare Shares more details are available in this video –

Evexia Lifecare Share Price Target 2023

The share has given bad returns in the last year of -2.70% and In the last 6 months it has given returns of -8.16%. The experts are forecasting that the share might not perform well this year. It is concluded that Evexia Lifecare Share Price Target 2023 can be INR 1.87 and the highest price can be INR 1.91.

Evexia Lifecare Share Price Target 2025

Evexia Lifecare’s fundamentals are also bad and its financials are also not good. The P/E ratio of the share is 0 which is not good, along with this the ROE and EPS are also very low.

Talking about its financials, the profit of the company is decreasing every year and its revenue and net worth have also declined a lot, which is not a good sign. The experts are forecasting that the lowest and the highest Evexia Lifecare Share Price Target 2025 will be INR 1.93 and INR 2.01.

Evexia Lifecare Share Price Target 2030

According to its historical data, it is predicted that Evexia share will not be a good investment for long-term or short-term investment. The predicted Evexia Lifecare Share Price Target 2030 can be INR 2.31 and the highest price can be INR 2.69.

So if you want to invest in this share then it is our strong advice to analyse the share by yourself. And in the case of penny stocks, I do not advise anyone to invest in this type of share.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Evexia Lifecare’s share price targets for 2024, 2025, 2026 and 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Evexia Lifecare company?

The debt of Evexia Lifecare company is ₹ 750 Crore and its debt-to-equity ratio is 7.79.

What is the share price of Evexia Lifecare in 2026?

The share price of Evexia Lifecare in 2026 can be ₹2.05 while the highest price can be ₹2.21.

Also Read –