Godha Cabcon & Insulation Ltd – Financials, Fundamentals, Detailed Analysis, and Godha Cabcon Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for Godha Cabcon Share Price Target, you are at the right place.

In this post, I will tell you about Godha Cabcon Share in which we will do a detailed analysis of Godha Cabcon shares businesses, fundamentals, financials, plans, and more.

Godha Cabcon is a small-cap stock whose condition is not good at all. This share has given a return of -42% from 2020 to 2023, which is bad right? Some investors are saying that this stock will give future multi-bagger returns, which makes no sense.

Godha Cabcon Overview

Godha Cabcon & Insulation Ltd. is a company that is present in the cable and conductor manufacturing industry.

The company was initially established by the late Shri Dilip Godha in 1987 in Dewas, India, where it successfully operated as a manufacturer of ACSR conductors and related products. Due to health reasons, Mr. Dilip Godha couldn’t continue overseeing the Dewas unit, and production stopped temporarily because his son, Mr. Dipesh Godha, was still a minor.

In 2006, the company set up a new unit in Indore, India, under the partnership firm M/S Godha Cabcon & Insulation, with partners including Mr. Dilip Godha, Mrs. Madhu Godha, and Mr. Dipesh Godha.

Over the years, Godha Cabcon has expanded its production capacity significantly, more than doubling it within three years.

The company manufactures various products, including ACSR conductor wire, stay wire, DPC wire, and XLP coated wire/conductor. They also introduced XLP-coated wire with new technology.

Godha Cabcon Financials

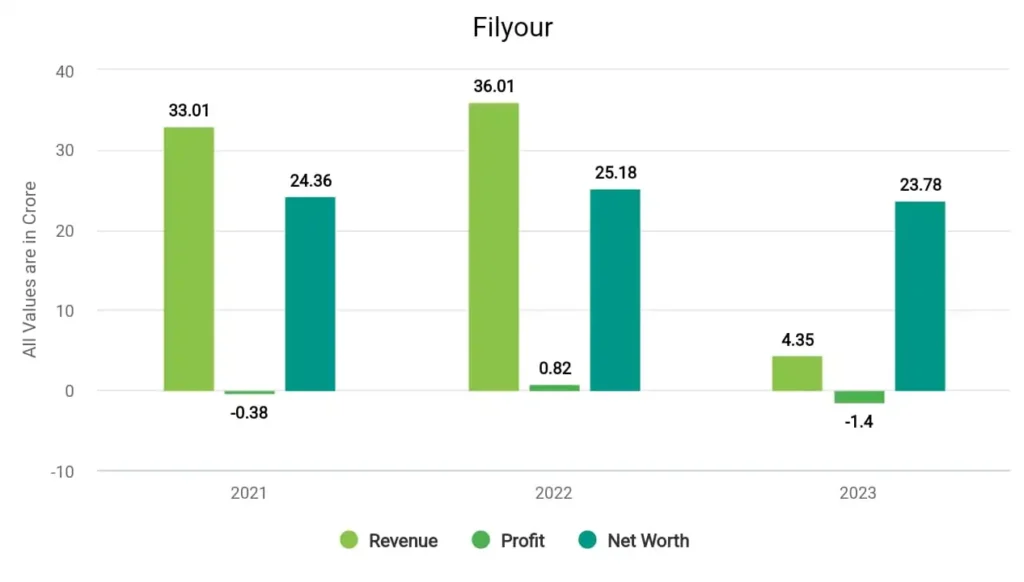

In 2021, the company’s revenue surged to ₹33.01 crore, and its profit was ₹-0.38 crore. In 2022, the company made a profit of ₹0.82 crore with a revenue of ₹36.01 crore. In 2023, Godha Cabcon earned a profit of ₹-1.4 crore and a revenue of ₹4.35 crore.

Godha Cabcon Fundamentals

| Market Cap. | ₹62 crore |

| P/E ratio | 93 |

| Industry P/E | 57.18 |

| ROE | 0.74% |

| EPS | 0.01 |

| Dividend Yield | 0% |

| Book Value | 1.03 |

| Debt to Equity | 0.03 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹62 Crores: ₹62 Crores, indicating that this is a small-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 93: A P/E ratio of 93 usually indicates that the company is trading at higher valuation.

- Industry P/E (Price-to-Earnings Ratio): 57.18: The industry’s average P/E ratio is 57.18. Comparing this to the company’s P/E of 93 suggests that the company is trading at a higher valuation.

- ROE (Return on Equity): 0.74%: ROE measures the company’s profitability relative to shareholders’ equity.

- EPS (Earnings Per Share): ₹0.01: An EPS of ₹0.01 means that the company did not report any earnings per share for the period in question. This is consistent with a P/E ratio of 0, indicating either losses or no earnings.

- Dividend Yield: 0%: A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹1.03: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹1.03 per share.

- Debt to Equity Ratio: 0.03: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 0.03 indicates that the company has 11 paise in debt for every rupee of equity.

Godha Cabcon Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Godha Cabcon Share Price Target 2024 | ₹0.95 | ₹0.99 |

| Godha Cabcon Share Price Target 2025 | ₹0.98 | ₹1.04 |

| Godha Cabcon Share Price Target 2026 | ₹1.01 | ₹1.09 |

| Godha Cabcon Share Price Target 2027 | ₹1.04 | ₹1.15 |

| Godha Cabcon Share Price Target 2028 | ₹1.07 | ₹1.21 |

| Godha Cabcon Share Price Target 2029 | ₹1.11 | ₹1.27 |

| Godha Cabcon Share Price Target 2030 | ₹1.14 | ₹1.33 |

Godha Cabcon Share more details are available in this video –

Godha Cabcon Share Price Target 2025

As we can see, the company’s fundamentals are much worse and getting worse day by day. The ROE of this share is 0.74% and the P/E ratio is 93 means maybe the company is not making any profit and trading at a higher valuation.

We have done lots of research and found nothing about its financial trends. But from some news, we have known that the financial condition of the company is super bad. Anyway, the experts are forecasting that the Godha Share Price Target 2025 can be INR 0.98 and the highest price can go up to INR 1.04.

Godha Cabcon Share Price Target 2030

This share has given a return of -5% in the last 6 months while in the last years, it has given a return of -67%. This decreasing returns of this share is quite concerning for investors and I do not invest in this type of shares.

Since this is a penny stock it’s strongly recommended that you stay away from this type of share who is fundamentally and financially weak. well, by looking at its historical data, it is predicted that Godha Cabcon’s Share Price Target in 2030 can be INR 1.14 and the highest price can be INR 1.33.

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Godha Cabcon’s share price target for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Godha Cabcon company?

The debt of Godha Cabcon company is₹ 2.35 crore and its debt-to-equity ratio is 0.03.

What is the share price of Godha Cabcon in 2025?

The share price of Godha Cabcon in 2025 can be ₹115,26 while the highest price can be ₹127.83.

Also Read –