HDIL Share Price Target 2024 – 2030 (Best Analysis of Housing Development & Infrastructure Limited stock, Fundamentals, Financials, Future Plans and more)

In today’s post, we will do a detailed analysis of Hdil (Housing Development & Infrastructure Limited stock), so you can decide whether to invest in it.

As We Know HDIL Company is a small-cap company, so risk is also higher than other stocks. so let’s analyze this stock, so it becomes easy for you to judge it.

HDIL is an Indian-based real estate development company. The company’s operations span every aspect of the real estate business, from commercial, residential, and retail projects to slum rehabilitation to land developments. It was founded in 1996.

HDIL Overview

HDIL i.e. Housing Development and Infrastructure Limited, is a real estate development company. HDIL is primarily engaged in the business of real estate development in Bharat. The company is known for its involvement in developing commercial, residential, and retail properties. Hdil projects often include housing complexes, shopping malls, and other real estate ventures.

HDIL has undertaken various high-profile real estate projects in different parts of Bharat. One of the notable areas of operation of HDIL is slum rehabilitation projects in Mumbai. The projects include redeveloping slum areas to provide better living conditions for the residents. In exchange for rehabilitating the slums, the company receives additional development rights that is the right to build and sell commercial or residential properties.

HDIL Financial Trends

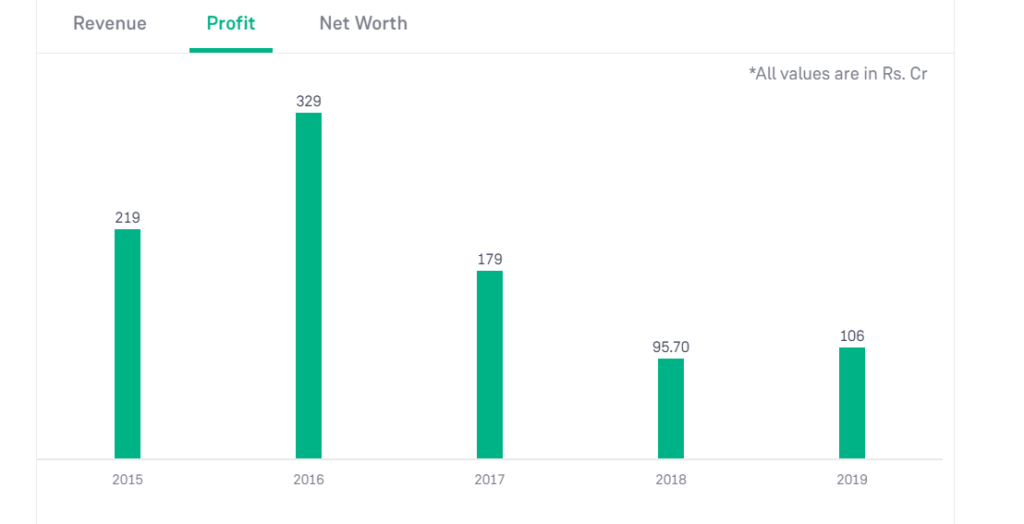

In 2017, the company’s revenue surged to 724 crores and profit was 179 crores. In 2018, the company made a profit of 95.70 crores with revenue of 388 crores. In 2019, Hdil earned a good profit of 106 crores and a revenue of 718 crores.

HDIL Company Fundamentals

| Share | HDIL Housing Development |

| Market cap. | ₹ 200Cr. |

| P/E ratio | 0 |

| Industry P/E | 89.48 |

| ROE | 0.45% |

| EPS | -0.21 |

| Book Value | -48.42 |

| Debt to Equity | -1.08 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹200 Crore: Market capitalization represents the total market value of a company’s outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): 0: A P/E ratio of 0 typically suggests that either the company has negative earnings or the earnings are not available.

- Industry P/E (Price-to-Earnings Ratio): 89.48: The industry’s average P/E ratio is 89.48. Comparing the company’s P/E of 0 with the industry average suggests that the company might not be generating positive earnings or might significantly underperform the industry average in terms of profitability.

- ROE (Return on Equity): 0.45%: A low ROE of 0.45% indicates that the company generated a profit of 0.45% for every rupee of shareholders’ equity. This suggests a relatively low level of profitability.

- EPS (Earnings Per Share): -0.21: The company incurred a loss of -0.21 for each outstanding share over a specific period.

- Book Value: -₹48.42: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s -₹48.42 per share, indicating a negative net asset value.

- Debt to Equity Ratio: -1.08: The debt-to-equity ratio measures a company’s financial leverage. A ratio of -1.08 indicates that the company has a negative debt-to-equity ratio, which is unusual and may be due to negative equity.

HDIL Share Price Target Table

| YEAR | Lowest Price | Highest Price |

| HDIL Share Price Target 2023 | ₹4.80 | ₹5.20 |

| HDIL Share Price Target 2024 | ₹5.80 | ₹6.30 |

| HDIL Share Price Target 2025 | ₹7.50 | ₹9.20 |

| HDIL Share Price Target 2026 | ₹14 | ₹14.60 |

| HDIL Share Price Target 2027 | ₹16.10 | ₹16.70 |

| HDIL Share Price Target 2028 | ₹21.30 | ₹22.50 |

| HDIL Share Price Target 2029 | ₹28 | ₹35 |

| HDIL Share Price Target 2030 | ₹43 | ₹52 |

Hdil (Housing Development and Infrastructure Limited) Share more details are available in the provided video –

Hdil Share Price Target 2025

Hdil Share Price Target 2025 can be INR 7.50 and the highest price can be INR 9.20. Well, the fundamentals and financials of this company are not so good. Currently, its ROE is only 0.87% and its EPS is -0.42 while the P/E ratio is 0 which is a sign that investors are not showing their interest in this share.

Looking at its financial trends, the profit of Hdil is continuously falling every year, which is not a good sign. The analysts are predicting that the profit may decline this year too by 10%, Due to which we may see a decline in share price.

Hdil Share Price Target 2030

Looking at its past performance, experts have predicted that Hdil Share Price Target 2030 can be INR 43 while the highest price goes up to INR 52. This has given -21% returns in the past 6 months while -60% returns in the past 1 year, which sounds bad right? So, Investing in this share is quite risky that’s why many investors are advising people to stay away from this type of shares.

Is Hdil a good stock to buy now?

No, according to our analysis, investing in Hdil shares is quite risky. Because the company is fundamentally and financially weak, many investors hesitate to invest in it. Our recommendation will always that invest in such types of stocks whose fundamentals and financials are strong and have good future potential.

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about HDIL’s share price target for 2024, 2025, 2026 and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What will the share price of Hdil be in 2025?

The share price of Hdil in 2025 can be INR 7.50 – INR 9.20.

What will the share price of Hdil be in 2030?

The share price of Hdil in 2030 can be between INR 43 – and INR 52.

Is Hdil a Debt-free company?

Currently, Hdil has a debt of ₹ 2,484 Crore.

Also Read –

- BLS Infotech Share Price Target

- Zenith Steel Share Price Target

- Coffee Day Share Price Target

- GMDC Share Price Target

DISCLAIMER – Share Market Investments are subject to market risks, read all scheme-related documents carefully before investing.