IRB Infrastructure Developers Limited – Financials, Fundamentals, Detailed Analysis, and IRB Infrastructure Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

Are you looking for an IRB Infrastructure Share Price Target? If yes, then you are at the right place.

In this post, we are going to do a detailed analysis of IRB Infrastructure Shares, in which we will do a detailed analysis of this share plus we will also try to forecast IRB Share Price Target.

Hey, So before diving into the post, I want to give you a brief description of this share. IRB is a penny stock and this share has given returns of +67% from 2008 to 2023. Some investors are forecasting that this share will give multi-bagger returns in the future, will it be so? We will know in this post.

IRB Infrastructure Overview

IRB Infrastructure Developers Ltd is a prominent player in the infrastructure sector of Bharat. The company specializes in the operation, Development, and maintenance of road and highway projects. IRB has emerged as one of the leading infrastructure companies in India With a history dating back to 1998.

The portfolio of IRB Infra encompasses a wide range of road and highway projects that span across the country. The company is involved in the construction and management of these road assets, contributing significantly to the transportation infrastructure of Bharat. The company’s Developers are committed to enhancing connectivity, improving transportation, and driving economic growth through its projects.

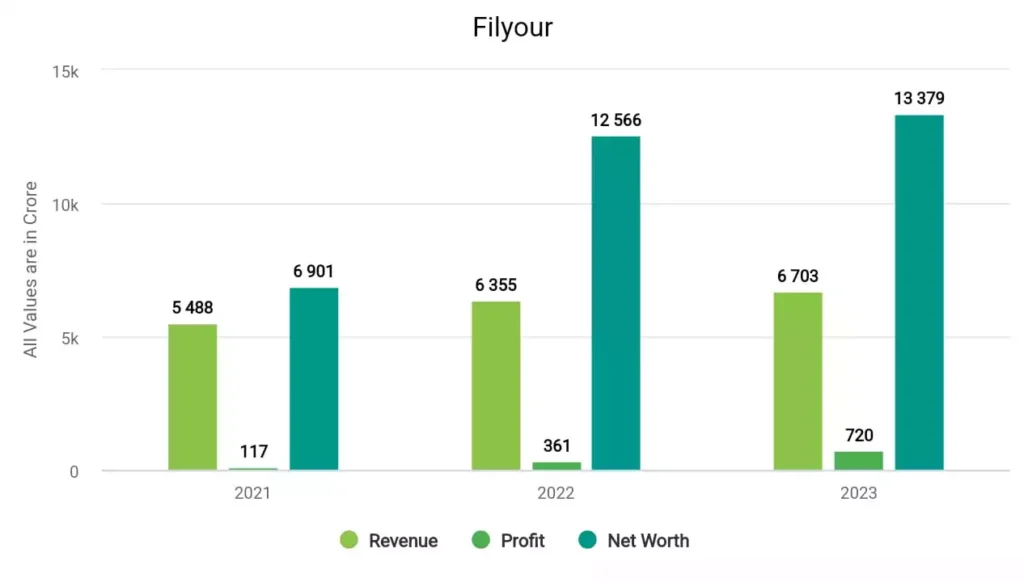

IRB Infrastructure Financials

In 2021, the company’s revenue surged to 5,488 crore, and its profit was 117 crore. In 2022, the company made a profit of 361 crore with a revenue of 6,355 crore. In 2023, IRB Infrastructure earned a profit of 720 crore and a revenue of 6,703 crore.

IRB Infrastructure Fundamentals

| Market Cap. | ₹39,066 crore |

| P/E ratio | 64.05 |

| Industry P/E | 35.98 |

| ROE | 4.41% |

| EPS | 1.01 |

| Dividend Yield | 0.46% |

| Book Value | 22.76 |

| Debt to Equity | 1.36 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹39,066 Crores: ₹39,066 Crores, indicating that this is a large-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 64.05: A P/E ratio of 64.05 indicates that investors are willing to pay ₹64.05 for every ₹1 of earnings per share (EPS). It suggests that the company’s stock is trading at a relatively high valuation compared to its earnings.

- Industry P/E (Price-to-Earnings Ratio): 35.98: The industry’s average P/E ratio is 35.98. Comparing this to the company’s P/E of 64..05 suggests that the company’s stock may be trading at a higher valuation than the industry average.

- ROE (Return on Equity): 3.69%: An ROE of 4.41% indicates that the company generated a profit of 4.41% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹1.01: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company earned ₹1.01 for each outstanding share over a specific period.

- Dividend Yield: 0.46%: A dividend yield of 0.46% suggests that the company pays an annual dividend equivalent to 0.46% of the stock’s current price.

- Book Value: ₹22.76: The book value per share is the company’s net asset value divided by the number of outstanding shares. In this case, it’s ₹22.76 per share.

- Debt to Equity Ratio: 1.36: A ratio of 1.36 indicates that the company has 1.36 rupees in debt for every rupee of equity. This suggests a moderate level of financial leverage.

IRB Infrastructure Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| IRB Infra Share Price Target 2023 | ₹63.59 | ₹64.24 |

| IRB Infra Share Price Target 2024 | ₹64.94 | ₹66.29 |

| IRB Infra Share Price Target 2025 | ₹66.33 | ₹68.47 |

| IRB Infra Share Price Target 2026 | ₹67.79 | ₹70.78 |

| IRB Infra Share Price Target 2027 | ₹69.30 | ₹73.22 |

| IRB Infra Share Price Target 2028 | ₹70.87 | ₹75.82 |

| IRB Infra Share Price Target 2029 | ₹72.50 | ₹78.57 |

| IRB Infra Share Price Target 2030 | ₹74.20 | ₹81.48 |

IRB Infrastructure Share more details are available in this video –

IRB Infrastructure Share Price Target 2024

This share has given a return of +20% in the last 6 months while in the last year, it has given a return of +35%, which sounds good right? If we look at its all-time returns then its return is only +67%, which is an average return of +4.5%. Considering this, the experts forecast that IRB Infra Share Price Target 2024 will be INR 34.94, and the highest price can reach up to INR 36.29.

IRB Infrastructure Share Price Target 2025

As we can see above, the financial trends of the company are good and its profit is also growing which is a good sign. If we look at its fundamentals, then it is also good but the thing is the company has a huge loan and its debt-to-equity ratio is 1.33, which indicates that the loan is much more than the value of the company.

Due to its loan, the higher portion of its profit goes on its interest which makes trouble for the company to grow in the future. And mostly, in the case of huge debt companies, it is seen that they don’t survive in the long term and as a result, the investment of investors also dies. Well, the first IRB Infra Share Price Target 2025 will be INR 36.33 and the highest price can be INR 38.47.

IRB Infrastructure Share Price Target 2030

I think a share with a huge debt will not be a good investment, mostly in penny stocks. The experts are predicting that its historical returns are also not good due to which IRB Infra Share Price Target 2030 can be INR 44.20 and the maximum price can be INR 51.48.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, Please tell by commenting. We have tried to know as much as possible about IRB Infrastructure Share Price Target 2024, 2025, 2026, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the future of IRB Infrastructure Share?

There is quite a possibility of getting multi-bagger returns from IRB Infrastructure share in the future. But for this, you have to invest in IRB shares wisely and for a long-term horizon.

Is IRB Infrastructure debt-free?

No, IRB Infrastructure has a debt of ₹ 18,097 Crore.

Also Read –