Kritika Wires Ltd – Financials, Fundamentals, Detailed Analysis, and Kritika Wires Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for Kritika Wires Share Price Target, then you are at the right place.

In this post, we will talk about Kritika Wires’s share in which we will do a detailed analysis of it. In this, we will also analyze its fundamentals, financials, and businesses, and of course, we will try to forecast Kritika Wires Share Price Target.

This share has given returns of +58% from 2022 to 2023, which is an average of 29% which sounds good right? But by seeing only past returns of the share, we can not determine whether it is good for investment. So let’s dive into the detailed analysis of Kritika Wires’ share, let’s get started.

Kritika Wires Overview

Kritika Wires Ltd is a proud member of the esteemed “Jai Hanuman Group,” which began its remarkable journey in 2004. With a strong commitment to quality and precision, the company has grown to become a leader in the manufacturing of various types of steel and galvanized wires. Their products serve the critical needs of State Electricity Boards, Power Grid Corporation of India Ltd., and other esteemed clients, both nationally and internationally.

Kritika Wires Ltd is dedicated to upholding the highest standards of quality. As evidence of this commitment, the company has achieved ISO certifications, including ISO 9001:2015, ISO 14001:2015, and OHSA S18001:2007. These certifications underscore Kritika Wires’ unwavering dedication to quality control and environmental responsibility in their manufacturing processes

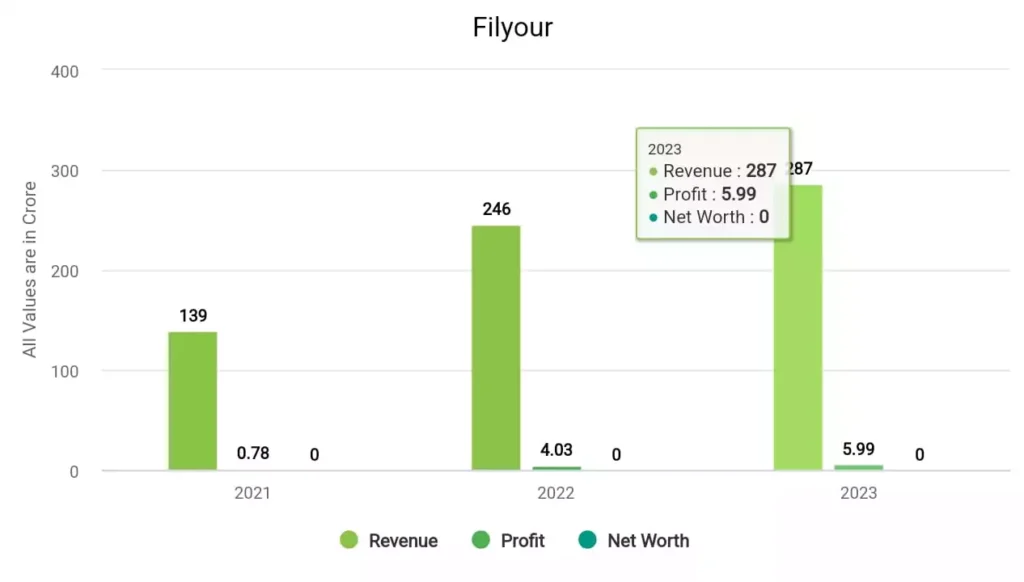

Kritika Wires Financial Trends

In 2021, the company’s revenue surged to ₹139 crore, and its profit was ₹0.78 crore. In 2022, the company made a profit of ₹4.03 crore with a revenue of ₹246 crore. In 2023, Kritika Wires made a profit of ₹5.99 crore and a revenue of ₹287 crore.

Kritika Wires Fundamentals

| Market Cap. | ₹508 crore |

| P/E ratio | 45.40 |

| Industry P/E | 17.97 |

| ROE | 12.33% |

| EPS | 0.42 |

| Dividend Yield | 0% |

| Book Value | 3.17 |

| Debt To Equity | 0.48 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹508 Crores: ₹508 Crores, suggesting that this is a small-cap company in market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 45.40: A P/E ratio of 45.40 indicates that investors are willing to pay ₹45.40 for every ₹1 of earnings per share (EPS).

- Industry P/E (Price-to-Earnings Ratio): 17.97: The industry’s average P/E ratio is 17.97. Comparing this to the company’s P/E of 45.40 suggests that the company’s stock may be trading at a higher valuation than the industry average.

- ROE (Return on Equity): 12.33%: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of 12.33% indicates that the company generated a profit of 8.08% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹0.42: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock. In this case, the company earned ₹0.42 for each outstanding share over a specific period.

- Dividend Yield: 0%:A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Book Value: ₹3.17: The book value per share is the net asset value of the company divided by the number of outstanding shares.

- Debt to Equity Ratio: 0.48: The debt-to-equity ratio measures a company’s financial leverage. A ratio of 0.48 indicates that the company has 48 paise in debt for every rupee of equity.

Kritika Wires Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Kritika Wires Share Price Target 2023 | ₹24.03 | ₹24.48 |

| Kritika Wires Share Price Target 2024 | ₹25.95 | ₹26.92 |

| Kritika Wires Share Price Target 2025 | ₹28.03 | ₹29.61 |

| Kritika Wires Share Price Target 2026 | ₹30.27 | ₹32.58 |

| Kritika Wires Share Price Target 2027 | ₹32.69 | ₹35.93 |

| Kritika Wires Share Price Target 2028 | ₹35.31 | ₹39.42 |

| Kritika Wires Share Price Target 2029 | ₹38.13 | ₹43.46 |

| Kritika Wires Share Price Target 2030 | ₹41.18 | ₹47.69 |

Kritika Wire Share more details are available in this video –

Kritika Wires Share Price Target 2024

This share has given a good return of +154% in the last 6 months while in the last 1 year, its return was not so which which is -0.22%. The experts predict that Kritika Wires Share Price Target 2024 can be INR 25.95 and INR 26.92 can be the highest price.

Kritika Wires Share Price Target 2025

The fundamentals of Kritika’s share are neither good nor bad. The P/E ratio of this share is 29.65, much greater than its industrial P/E. Its ROE which is 8.08% is almost good. By this, it is concluded that the lowest and highest Kritika Wires Share Price Target 2025 will be INR 28.03 and INR 29.61 respectively.

Kritika Wires Share Price Target 2026

Currently, its financial trends are almost good. The profit and revenue of the company is growing well, which is good. The analysts are forecasting that this share can give decent returns in the long run. By its past performance, the experts forecasted that the lowest Kritika Wires Share Price Target 2026 can be INR 30,27 and the highest price can be INR 32.58.

Kritika Wires Share Price Target 2030

Its historical data shows that Kritika Wires Share Price Target 2030 will be INR 41.18 and the highest price can be INR 47.69. The share may perform well in the long term, but if you want to invest in this share then you have to keep an eye on this stock.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Kritika Wires’ share price target for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What will the share price of Kritika Wires be in 2025?

The share price of Kritika Wires in 2025 can be INR 28.03 – INR 29.61.

Is Kritika Wires a debt-free company?

Currently, Kritika Wires has a debt of ₹ 40.1 Crore.

Also Read –