MFL India Ltd – Financials, Fundamentals, Detailed Analysis, and MFL India Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for MFL India’s share price target or its share analysis then you are at the right place.

In this post, I will tell you about MFL India’s share in which we will analyze the share, its businesses, fundamentals, financials, etc so that you can decide whether to invest in it or not.

Share of MFL India has given a return of -64% from 1995 to 2023 while in the last 5 years, it has given a return of +284%. Some investors are expecting multi-bagger returns from this share, but this share is very risky for investment. Why MFL India Share is Risky for Investment? we will know in this post.

MFL India Overview

MFL India Limited is a company primarily involved in the transport and logistics sector, with a self-owned fleet of a mixed variety of high-volume/heavy-weight cargo carriers. Here’s an overview of MFL India Limited:

MFL India Limited offers a diversified portfolio of transportation services. This includes the use of high-capacity trucks and trailers, which are crucial for moving goods efficiently across the country.

The company mentions an amalgamation with MFL Pharma Ltd due to a Scheme of mergers. This suggests that the company might have acquired or merged with another company and potentially expanded its services or business operations.

MFL India Financials

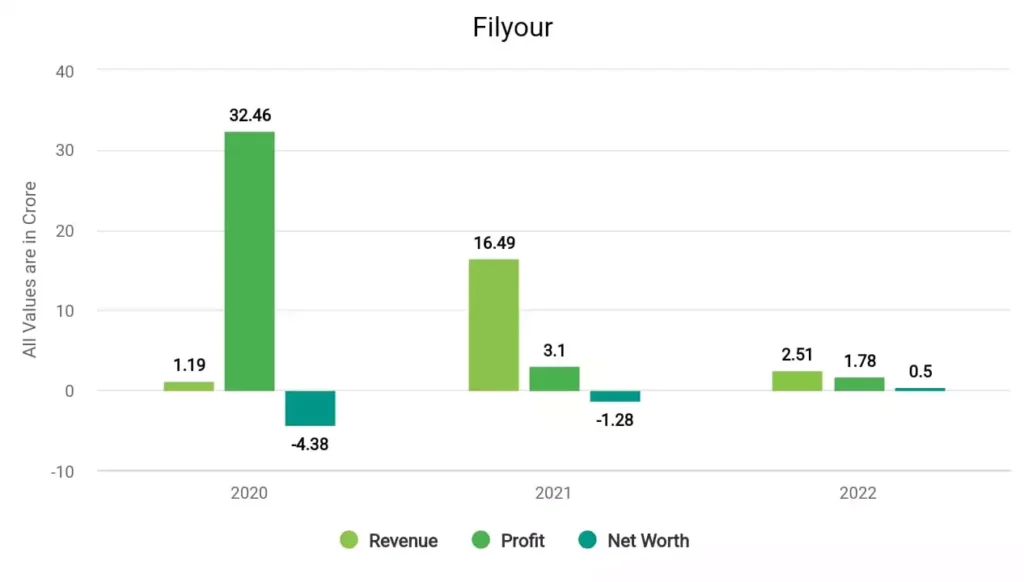

In 2020, the company’s revenue surged to ₹1.19 crore, and its profit was ₹32.46 crore. In 2021, the company made a profit of ₹3.1 crore with a revenue of ₹16.49 crore. In 2022, MFL India made a profit of ₹1.78 crore and a revenue of ₹2.51 crore.

MFL India Fundamentals

| Market Cap. | ₹26 crore |

| P/E ratio | 0 |

| Industry P/E | 57.45 |

| ROE | 1744% |

| EPS | -0.05 |

| Book Value | 0.00 |

| Dividend Yield | 0 |

| Debt-to-Equity | -503.36 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹26 Crore: Market capitalization represents the total market value of a company’s outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): 0: A P/E ratio of 0 typically suggests that either the company has negative earnings or the earnings are not available.

- Industry P/E (Price-to-Earnings Ratio): 57.45: The industry’s average P/E ratio is 57.45. Comparing the company’s P/E of 0 with the industry average suggests that the company might not be generating positive earnings or might significantly underperform the industry average in terms of profitability.

- ROE (Return on Equity): 1744%: A high ROE of 1744% indicates that the company generated a substantial profit of 1744% for every rupee of shareholders’ equity. However, extreme values like this may be indicative of unique circumstances, such as a small equity base.

- EPS (Earnings Per Share): -0.05: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock.

- Book Value: ₹0.00: The book value per share is the net asset value of the company divided by the number of outstanding shares.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price.

- Debt-to-Equity Ratio: -503.36: The debt-to-equity ratio measures a company’s financial leverage. A ratio of -503.36 indicates that the company has a negative debt-to-equity ratio, which is unusual and may be due to negative equity.

MFL India Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| MFL India Share Price Target 2023 | ₹0.79 | ₹0.81 |

| MFL India Share Price Target 2024 | ₹0.82 | ₹0.85 |

| MFL India Share Price Target 2025 | ₹0.85 | ₹0.91 |

| MFL India Share Price Target 2026 | ₹0.89 | ₹0.96 |

| MFL India Share Price Target 2027 | ₹0.92 | ₹1.02 |

| MFL India Share Price Target 2028 | ₹0.96 | ₹1.08 |

| MFL India Share Price Target 2029 | ₹1 | ₹1.14 |

| MFL India Share Price Target 2030 | ₹1.04 | ₹1.21 |

MFL India Share more details are available in this video –

MFL India Share Price Target for 2025

This share has given a return of +10% in 6 months but -32% in last year, which sounds bad right? If we look at its fundamentals then it is not so good even that the company debt is more than 29 times its equity, which is a huge amount.

The experts are saying that this stock is not good for short-term as well as long-term investment. So according to its past performance, it is forecasted that MFL India Share Price Target 2025 will be INR 0.85 and the highest price can be INR 0.91.

MFL India Share Price Target for 2030

The financials of this company are also bad because its profit, revenue, and net worth are decreasing every year. No experts are suggesting this share as a good investment for the investors. By the way, by analyzing its historical data, it is concluded that MFL India Share Price Target 2030 can be INR 1.04 and the highest price can be INR 1.21.

Is it good to Invest in MFL India Share?

No, the fundamental and financial condition of MFL India’s share is not good so far. Investing in this share will be very risky and there is a high chance of losing its money. Again, if you want to invest in this share then once analyze the share from your end and invest the only money in it which will not affect your financial condition if you lose your money in MFL India.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about MFL India’s share price target for 2024, 2025, 2026 and 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of MFL India Company?

The debt of MFL India Company is ₹ 15 crore and its debt-to-equity ratio is -503.36.

What is the share price of MFL India in 2024?

The share price of MFL India in 2025 can be ₹0.82 while the highest price can be ₹0.85.

Also Read –