Patel Engineering Ltd. – Financials, Fundamentals, Detailed Analysis, and Patel Engineering Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030, 2035).

Patel Engineering is one of the penny shares with an immense return of 206% in the last year. So, if you want to know its share price target and share analysis then you are at the right place.

Many investors are just predicting that it will double your money by 2025 while some say this share is not good for long-term investment. I have brought up a detailed post regarding Patel Engineering’s share price future in this situation.

So let’s dive into the post but before this let’s take an overview of Patel Engineering share. Stay tuned till the end of this post, let’s get started.

Patel Engineering Overview

Patel Engineering Limited is an Indian infrastructure company that operates in the construction and development of major infrastructure projects. Established in 1949, this company has a concrete presence in varied sectors, including hydropower, tunnels, dams, irrigation, and transportation infrastructure.

Patel Engineering has undertaken and successfully executed multiple projects in India and internationally, contributing to developing critical structures. The company’s projects frequently involve complex engineering solutions, and it has accumulated a character for its expertise in the construction of large-scale infrastructure, especially in the field of hydropower.

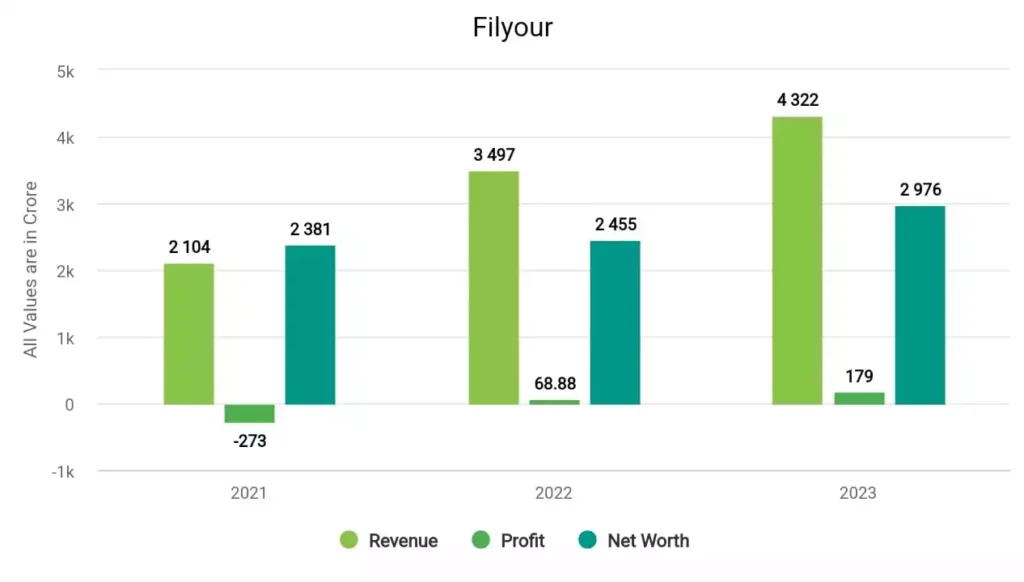

Patel Engineering Financial Trends

In 2021, the company’s revenue surged to ₹2,104 crore, and its profit was ₹-273 crore. In 2022, the company made a profit of ₹68.88 crore with a revenue of ₹3,497 crore. In 2023, Patel Engineering earned a profit of ₹179 crore and a revenue of ₹4,322 crore.

Patel Engineering Fundamentals

| Market Cap. | ₹4,474 Crore |

| P/E ratio | 15.67 |

| Industry P/E | 36.55 |

| ROE | 6.91% |

| EPS | 3.38 |

| Book Value | 42.09 |

| Dividend Yield | 0% |

| Debt to Equity | 0.61 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹4,474 Crores: Market capitalization represents the total market value of a company’s outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): 15.67: A P/E ratio of 15.67 indicates that investors are willing to pay ₹15.67 for every ₹1 of earnings per share (EPS). It suggests that the company’s stock is trading at a moderate valuation compared to its earnings.

- Industry P/E (Price-to-Earnings Ratio): 36.55: The industry’s average P/E ratio is 36.55. Comparing this to the company’s P/E of 15.67 suggests that the company’s stock may be trading at a slightly lower valuation than the industry average.

- ROE (Return on Equity): 6.91%: An ROE of 6.91% indicates that the company generated a profit of 6.91% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹3.38: EPS represents the portion of a company’s profit allocated to each outstanding share of common stock.

- Book Value: ₹42.09: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹42.09 per share.

- Dividend Yield: 0%: A dividend yield of 0% suggests that the company did not pay dividends during the period.

- Debt to Equity Ratio: 0.61: A ratio of 0.61 indicates that the company has 0.61 rupees in debt for every rupee of equity.

Patel Engineering share price target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Patel Engineering Share Price Target 2024 | ₹62.42 | ₹65.07 |

| Patel Engineering Share Price Target 2025 | ₹73.66 | ₹80.03 |

| Patel Engineering Share Price Target 2026 | ₹86.92 | ₹98.44 |

| Patel Engineering Share Price Target 2027 | ₹102.56 | ₹121.08 |

| Patel Engineering Share Price Target 2028 | ₹121.02 | ₹148.93 |

| Patel Engineering Share Price Target 2029 | ₹142.81 | ₹183.18 |

| Patel Engineering Share Price Target 2030 | ₹168.51 | ₹225.32 |

| Patel Engineering Share Price Target 2035 | ₹198.84 | ₹340.88 |

Patel Engineering Share more details are available in this video –

Patel Engineering Share Price Target 2024

Patel Engineering is a penny stock that has given a return of +116% in the last 6 months while +216% in the last year. If we see its all-time returns then it is so bad at -29%. It is predicted that the stock can give returns of a maximum of +25% this year. That is, Patel Engineering share price target 2024 can be INR 62.42 and the highest price can go up to INR 65.07.

Patel Engineering Share Price Target 2025

According to its fundamentals, we can not get any good returns from this share. The experts are saying that this share may perform well in the short run but in the long term, it can not be considered a good investment. The lowest and highest predicted Patel Engineering share price target 2025 can be INR 73.66 and INR 80.03 respectively. If you want to invest in this share then once check its current fundamentals and financials and based on this, make your investment decision.

Patel Engineering Share Price Target 2030

Since this is a penny stock and in in long term it is often seen that this type of share has underperformed. According to its historical data, the lowest Patel Engineering share price target 2030 will be INR 198.84 while the highest price can be INR 340.88. This forecast has been made by analyzing its past performance and its historical data.

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Patel Engineering’s share price target for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

Is Patel Engineering debt-free?

No, Patel Engineering has a debt of ₹2,005 and its debt-to-equity ratio is 0.68.

Is Patel Engineering a good buy?

The share has given a good return in the last 6 months but the thing is, because it is penny stock and its decent fundamentals and financials, Patel Engineering will not considered a good buy.

What is the Patel Engineering share price target in 2026?

Patel Engineering’s share price target for 2026 can be INR 86.92 and the second target price can be INR 98.44.

Also Read –