Tradecred Review | Tradecred (Returns, Legal, Pros & Cons, Founder, Customers Care, Complaints and more) | Is Tradecred Safe?

Do you want to earn a fixed rate of returns in your investment which will be much more than the bank returns? If yes, then this Tradecred Review is just for you.

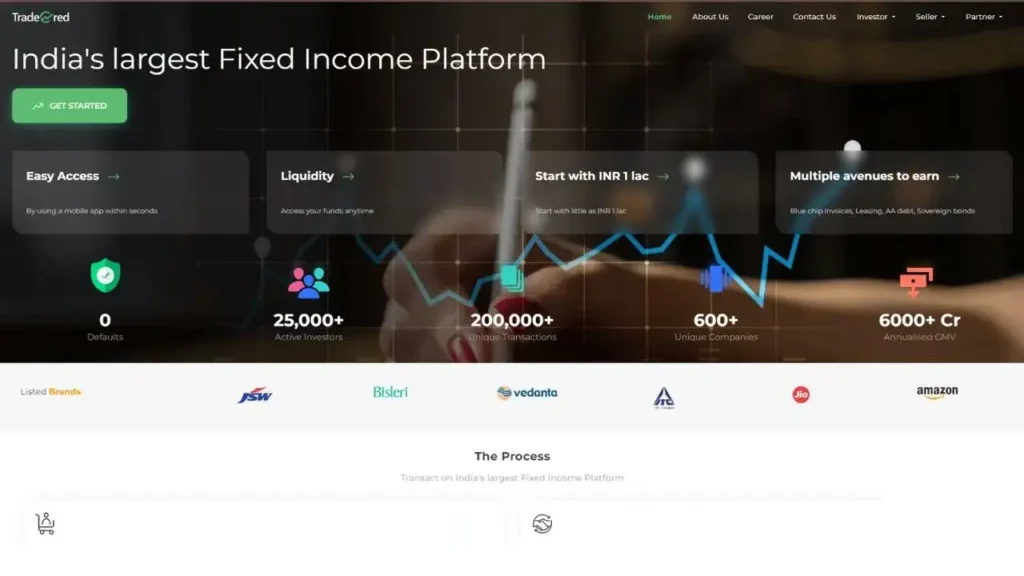

Tradecred is just made for people who want to earn a fixed rate of returns by investing in it. The company is offering up to 14% annual returns and more than 25000 investors are connected through this platform.

So if you are also willing to be part of this investor community then this post can prove to be a gem for you. In this post, we will talk about the positive as well as the negative aspects of the Tradecred App. So stay tuned till the end of the Tradecred Review post, let’s get started.

Tradecred Overview

Tradecred is one of India’s largest fixed-income platforms which was founded by Hardik Shah and Kunal Tekwani in 2018. The company offers 14% annual returns which is much higher than any bank returns. The company is an invoice discounting platform. That is, Tradecred uses the investor’s money to discount the invoice of any business. Let’s understand it in detail.

Suppose there is a seller and a buyer. The buyer buys a product from the seller and gives the seller a guarantee in the form of an Invoice that the buyer will pay him the money after 60 days. But the seller is in urgent need of money. So in this case he will go for invoice discounting in which he will give the invoice to the financier. So here the financier will give 80% of the amount mentioned in the challan to the seller and the remaining 20% is the financier’s profit.

Hence TradeCred buys the invoices at a lower price and the remaining profit after brokerage deduction is transferred to the investors’ accounts.

How does Tradecred work?

- The company pulls the money from the investors, let’s say Rs 80.

- The company purchases the invoice from the sellers at a discount, (Rs. 100 – Rs. 20 = Rs 80).

- The company issues the invoice to the buyer at the given cost, (Rs. 100).

- The discounted rate is the company’s profit (Rs. 100 – Rs. 80= Rs. 20).

Advantages of Tradecred

Some of the advantages of Tradecred are as follows –

- You can get good returns on your investment.

- The rate of returns is up to 14%.

- Less time in depositing money and setting up your investment profile.

Disadvantages of Tradecred

Some of the disadvantages of Tradecred are as follows –

- The rate of returns is not so fixed, it varies from situation to situation.

- Withdrawal takes some time.

- The minimum investment through this platform is 1 lakhs which is very high for some people.

Tradecred Review

Tradecred is a good platform for people willing to invest their money. The company claims to deliver up to 14% of returns on the investment, which is good. Tradecred is rated 3.4⭐ in the Play Store and the customers claim that there are many bugs in their app. The company has more than 25000 active investors in their platform. From these customers, we have collected some of the reviews of Tradecred, which are as follows –

Ankit Malodiya – “The application appears promising, with good deals, but the issue arises when it comes to liquidating the investment. When you urgently need your hard-earned money, the process seems to stall. It’s been almost two weeks since I requested to liquidate a portion of my investment, but there has been no action from the TradeCred side“

Gaurav Khurana – “I’ve been unable to liquidate my investment for the past three months, and there’s been no support available. It seems like this platform is heading towards failure, and people are at risk of losing their money. My advice: Avoid investing on this platform altogether!”

Amit Aggarwal – “Invoice discounting is a promising investment instrument, and TradeCred is a reputable brand known for maintaining its brand value. However, their app needs some improvements, especially regarding notifications. Often, deals appear without associated information.“

Conclusion

Tradecred is a good platform who want to invest their money in invoice discounting. The company provides almost good returns which is up to 14%. However, there are certain risks that you have to bear while investing in it. Since any investment option is not 100% risk-free, if you want to diversify your portfolio, Tradecred can be a good option.

I hope you loved reading this post. If you want to invest in Tradecred, you can reference this post. If you have any doubts or questions, you can ask by commenting. And yes, If possible then please share it with your friends.

FAQs

Is Tradecred Safe?

Yes, Tradecred is almost safe. However, there are certain risks in invoice discounting.

Is Tradecred approved by RBI?

No, Tardecred is not a RBI approved company.

Also Read –

- Univest App Review

- Grip Invest Review

- Mobikwik Xtra Review