UCO Bank Services Ltd – Financials, Fundamentals, Detailed Analysis, and UCO Bank Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

UCO Bank is a public-sector bank whose share is trading at around INR 40. If you are looking for UCO Bank Share Price Target then you are at the right place.

Basically in this post, we will analyze this share so that you can make further decisions of investing in it or not. This bank share has given a return of +93% from 2003 to 2023, an average of +4.65% every year.

UCO Bank has performed well in the past decade, but some investors predict that this share can perform well. By the way, let’s have a look at the business of the bank and then we will try to forecast UCO Bank Share Price Target.

UCO Bank Overview

UCO Bank is a leading public sector bank in India with a rich history dating back to its establishment in 1943. The Bank is headquartered in Kolkata, West Bengal, with a wide network of branches and a significant presence in the Indian banking sector.

As a nationalized bank, UCO Bank offers its customers a wide range of banking and financial services. These services include retail banking, corporate banking, international banking, and treasury. The Bank is important in facilitating financial inclusion by offering various products such as savings accounts, fixed deposits, loans, and other banking services to a diverse customer base.

UCO Bank Financials

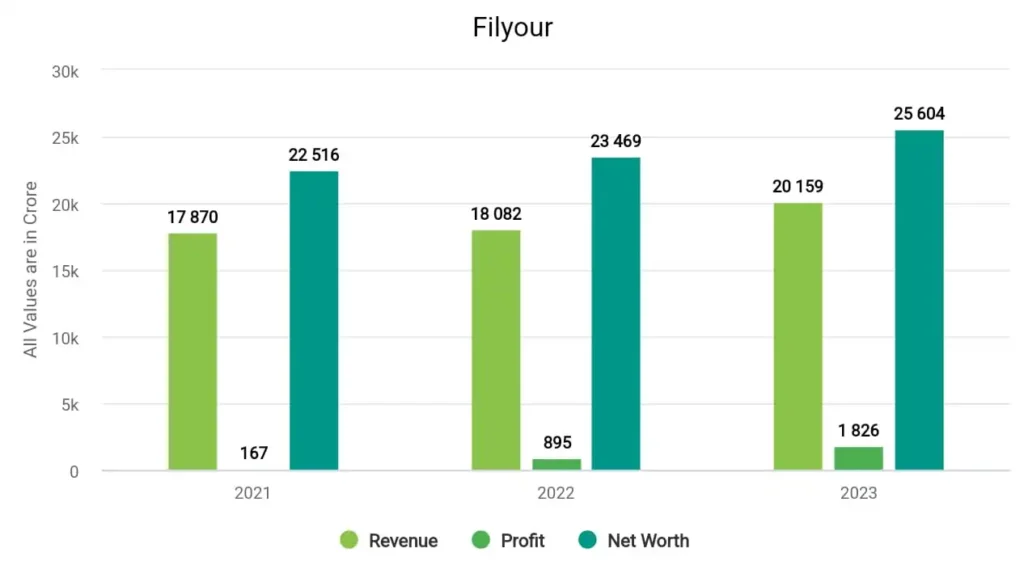

In 2021, the company’s revenue surged to ₹17,870 crores, and its profit was ₹167 crore. In 2022, the company made a profit of ₹895 crore with a revenue of ₹18,082 crore. In 2023, UCO Bank earned a strong profit of ₹1,826 crore and a revenue of ₹20,159 crore.

UCO Bank Fundamentals

| Market Cap. | ₹61,585 Crore |

| P/E ratio | 30.84 |

| Industry P/E | 13.82 |

| ROE | 8.31% |

| EPS | 1.67 |

| Book Value | 20.14 |

| Dividend Yield | 0.54% |

| Debt | ₹ 2,88,461 Cr. |

| Debt to Equity | 10.5 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹61,585 Crores: This is a large-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): 30.84: A P/E ratio of 30.84 indicates that investors are willing to pay ₹30.54 for every ₹1 of earnings per share (EPS). It suggests that the company’s stock is trading at a moderate valuation compared to its earnings.

- Industry P/E (Price-to-Earnings Ratio): 13.82: Comparing this to the company’s P/E of 30.84 suggests that the company’s stock may be trading at a higher valuation than the industry average.

- ROE (Return on Equity): 8.31 %: ROE measures the company’s profitability relative to shareholders’ equity. An ROE of 8.31% indicates that the company generated a profit of 8.31% for every rupee of shareholders’ equity.

- EPS (Earnings Per Share): ₹1.67: The company earned ₹1.67 for each outstanding share over a specific period.

- Book Value: ₹20.14: The book value per share is the net asset value of the company divided by the number of outstanding shares. In this case, it’s ₹20.14 per share.

- Dividend Yield: 0.54%: A dividend yield of 0.54% suggests that the company did not pay dividends during the period.

- Debt: ₹2,88,461 Crores: The total debt held by the company is ₹2,69,839 Crores.

- Debt to Equity Ratio: 10.5: A ratio of 10.5 indicates that the company has 10.5 rupees in debt for every rupee of equity. This suggests a high level of financial leverage, which can be risky.

UCO Bank Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| UCO Bank Share Price Target 2024 | ₹39.48 | ₹41.36 |

| UCO Bank Share Price Target 2025 | ₹41.45 | ₹45.50 |

| UCO Bank Share Price Target 2026 | ₹43.53 | ₹50.05 |

| UCO Bank Share Price Target 2027 | ₹45.70 | ₹55.05 |

| UCO Bank Share Price Target 2028 | ₹47.99 | ₹60.56 |

| UCO Bank Share Price Target 2029 | ₹50.39 | ₹66.61 |

| UCO Bank Share Price Target 2030 | ₹52.91 | ₹73.27 |

| UCO Bank Share Price Target 2035 | ₹55.55 | ₹80.60 |

UCO Bank Share More Details are Available in This Video –

UCO Bank Share Price Target 2024

UCO Bank has performed quite well in 1 year. The share surged to +81% in the last 1 year while in the last 6 months, it has given a return of +42%. The experts predict that this bank can give returns of up to 24% in the year. That is, UCO Bank Share Price Target 2024 can be INR 39.48 whereas the highest price can go up to INR 41.36.

UCO Bank Share Price Target 2025

The fundamentals of the bank are good and currently improving. The P/E ratio is 24.48 and its EPS and ROE are 1.54 and 7.84% which is decent. However, certain things are quite concerning for the bank. UCO Bank has delivered a poor sales growth of +4.71% over the past five years, which is bad. By the way, the forecasters are predicting that UCO Bank Share Price Target 2025 will be INR 41.45 while the highest price can be INR 45.50.

UCO Bank Share Price Target 2030

Looking at its historical data and past performance, we can assume that the bank can give decent returns on the investment. Since UCO is a trusted bank with a presence of over 60 years the company has performed well in that year. So the experts forecasted that the lowest and highest UCO Bank Share Price Target 2030 can be INR 52.92 and INR 73.27 respectively.

Conclusion

The UCO Bank share can give multi-bagger returns, but something concerning this stock will affect the share price. As we analyze the stock that has given good returns in the past, there is also the possibility of getting good returns.

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about UCO Bank’s share price target for 2024, 2025, 2026, and 2030. If you want to know anything else about it, then you can comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of UCO Bank company?

The debt of UCO Bank company is ₹ 2,88,461 crore that’s why its debt-to-equity ratio is 7.80.

What will be the share price target of UCO Bank for 2024?

The lowest and highest share price target of UCO for 2024 will be INR39.48 and INR41.36.

Also Read –