Zenith Steel Pipes & Industries Ltd Fundamentals, Financials, Businesses, and Zenith Steel Share Price Target (2024, 2025, 2026, 2027, 2028, 2029, 2030).

If you are looking for Zenith Steel Share Price Target, then you are at the right place.

Zenith Steel Pipes & Industries Ltd is a Bharat-based company that is engaged in manufacturing and selling electric resistance welded and hot dip galvanized pipes. The share has given a return of -86% from 2007 to 2023.

Some investors are predicting that Zenith Steel stock will give good returns this year. So will this share perform well in 2023? As we can see, the share has given an average return of -5%, which sounds bad right?

So, let’s analyze and forecast the Zenith Steel Share Price Target so that you can decide whether to invest in it or not.

Zenith Steel Overview

Zenith Steel Pipes & Industries Limited is a company that makes and sells different kinds of pipes. These pipes are used for many things like giving water to farms, making buildings, and even transporting water in large quantities.

They have three main types of pipes:

- Black Pipes: These are regular pipes.

- GI Pipes: These pipes are coated with a special material to make them more durable.

- HSAW Pipes: These pipes are big and used to move a lot of water.

As we said, the pipes of Zenith are used for various purposes, like farms, buildings, and factories and they also send their pipes to the United States and other countries. The company works on projects in Bharat and other countries, helping to build important things like water systems and buildings.

In simple terms, Zenith Steel Pipes makes pipes for various purposes, and they do this not only in India but also in exports to countries like the United States.

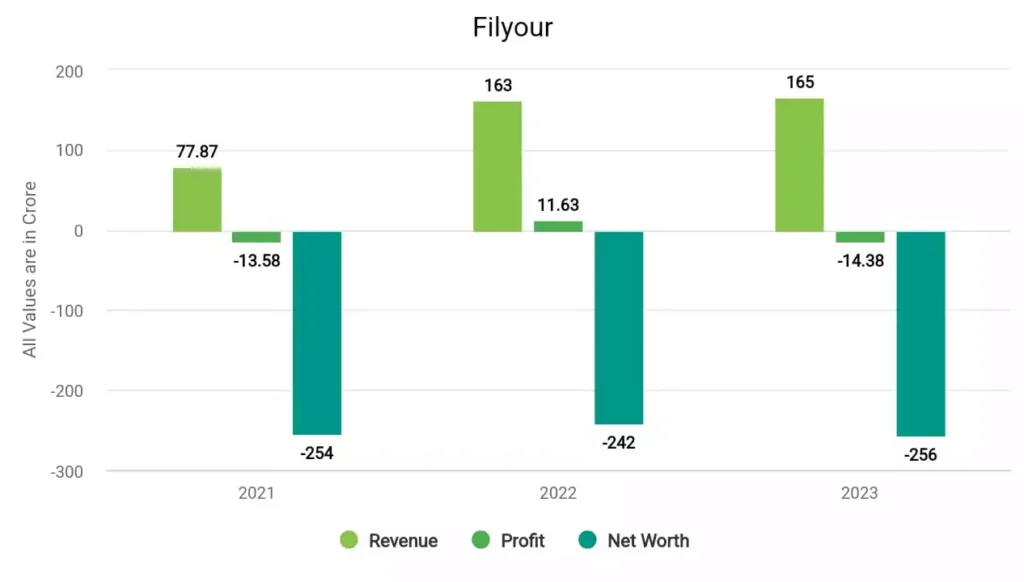

Zenith Steel Financials

In 2021, the company’s revenue surged to ₹77.87 crore, and its profit was ₹-13.58 crore. In 2022, the company made a profit of ₹11.63 crore with a revenue of ₹163 crore. In 2023, Zenith Steel earned a profit of ₹-14.38 crore and a revenue of ₹165 crore.

Zenith Steel Fundamentals

| Market Cap. | ₹132 Crore |

| P/E ratio | -464 |

| Industry P/E | 23.28 |

| ROE | 0.18% |

| EPS | -0.02 |

| Book Value | -18.05 |

| Dividend Yield | 0 |

| Debt to Equity | -0.84 |

Metrics Explained –

- Market Cap (Market Capitalization): ₹132 Crores: Market capitalization represents the total market value of a company’s outstanding shares. In this case, it’s ₹132 Crores, indicating that this is a small-cap company in terms of market capitalization.

- P/E Ratio (Price-to-Earnings Ratio): -464: A P/E ratio of 0 usually indicates that the company has reported negative earnings or no earnings.

- Industry P/E (Price-to-Earnings Ratio): 23.28: The industry’s average P/E ratio is 23.28. Comparing this to the company’s P/E of 0 suggests that the company might not be generating positive earnings or might be significantly underperforming the industry average in terms of profitability.

- ROE (Return on Equity): 0.18%: ROE measures the company’s profitability relative to shareholders’ equity. A positive ROE of 0.18% indicates that the company’s earnings are generating a return for shareholders relative to their equity investment. This is a healthy ROE.

- EPS (Earnings Per Share): ₹-0.02: An EPS of ₹-0.02 means that the company did not report any earnings per share for the period in question. This is consistent with a P/E ratio of -0.02, indicating either losses or no earnings.

- Book Value: -₹18.05: The book value per share is the net asset value of the company divided by the number of outstanding shares. A negative book value per share can be unusual and potentially concerning, as it suggests that the company’s liabilities exceed its assets per share.

- Dividend Yield: 0%: The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price. A dividend yield of 0% suggests that the company did not pay any dividends during the period.

- Debt to Equity Ratio: -0.84: The debt-to-equity ratio is a measure of financial leverage. A ratio of -0.83 indicates a negative equity position, implying that the company’s liabilities exceed its equity.

Zenith Steel Share Price Target Table

| Year | Lowest Price | Highest Price |

|---|---|---|

| Zenith Steel Share Price Target 2023 | ₹4.41 | ₹4.54 |

| Zenith Steel Share Price Target 2024 | ₹4.63 | ₹4.90 |

| Zenith Steel Share Price Target 2025 | ₹4.86 | ₹5.29 |

| Zenith Steel Share Price Target 2026 | ₹5.11 | ₹5.71 |

| Zenith Steel Share Price Target 2027 | ₹5.36 | ₹6.17 |

| Zenith Steel Share Price Target 2028 | ₹5.63 | ₹6.66 |

| Zenith Steel Share Price Target 2029 | ₹5.91 | ₹7.20 |

| Zenith Steel Share Price Target 2030 | ₹6.21 | ₹7.77 |

Zenith Steel Shares more details are available in this video –

Zenith Steel Share Price Target 2023

Zenith Steel Pipes share is a small cap share whose market cap is much below ₹5000 crore. The share has given a return of -30% in the last 1 year while +6% in the last 6 months. The analysts are predicting that Zenith Steel Share Price Target 2023 will be INR 4.41 and the highest price can be INR 4.54.

Zenith Steel Share Price Target 2024

Currently, the fundamentals of the company are not so good, the Book Value of Zenith Steel is -18.01 which is considered very bad. Along with this, the company is in greater loss due to which its debt to equity ratio is -0.86. Experts are not sure about its future fundamentals because it’s showing unpredictable movement in its share price. Well, Zenith Steel Share Price Target 2024 can be INR 4.63 while its highest price can be INR 4.90.

Zenith Steel Share Price Target 2025

The financial condition of Zenith Steel is also not good because the company is making losses every year. By the way, There has been growth in the revenue of the company but this has not had any significant impact on its profit because most of it goes into paying the interest on the debt. Because its profit is not good, that’s why experts are forecasting that Zenith Steel Share Price Target 2025 can be INR 4.86 while the highest price can be INR 5.29.

Zenith Steel Share Price Target 2030

By looking at its historical data, it is being forecasted that Zenith Steel Share Price Target 2030 will be INR 6.21 and the highest price can be INR 7.77. If you want to invest in this share once definitely then check its latest financial and fundamental conditions because investing in this type of stock is very risky.

| Homepage👉 | Click Here |

| Stock Market Update👉 | Join Now |

| Best Demat Account👉 | Create Account |

Conclusion

So how did you like this blog, please tell by commenting. We have tried to know as much as possible about Zenith Steel’s share price target for 2023, 2024, 2025, and 2030.

If you want to know anything else about it, then you comment, and we will try our best to give you the best answer. And yes, If you Liked this article, then definitely share it as much as possible.

FAQs

What is the Debt of Zenith Steel company?

The debt of Zenith Steel company is ₹ 220 crore and its debt-to-equity ratio is -0.86.

What is the share price of Zenith Steel in 2025?

The share price of Zenith Steel in 2025 can be ₹4.86 while the highest price can be ₹5.29.

Also Read –